Rural Washingtonians Often Use Land Contracts

Despite recent declines, Washington state remains a hotbed of land contract activity

Overview

Tens of thousands of Washington residents have used land contracts to purchase homes, farms, and businesses over the last two decades. Land contracts—legally known as “real estate contracts” in Washington and sometimes referred to as “contracts for deed”—are often risky and costly for buyers.1 But research shows that buyers who are unable to qualify for a mortgage or prefer not to use one often turn to land contracts when they have no other options to finance their home purchase.

This fact sheet provides an overview of the land contract market in Washington. To produce this report, researchers from The Pew Charitable Trusts analyzed data collected by county tax assessors and offices of the recorder of deeds to identify: 1) geographic regions where land contracts are common; 2) the characteristics of housing units purchased with land contracts; and 3) the costs of using contracts compared with mortgages.

What is a land contract?

A land contract is a form of alternative financing in which the buyer agrees to purchase a home or other piece of real estate directly from the seller, rather than through a mortgage lender. With a land contract, the buyer gives a down payment directly to the seller, who finances the remainder of the purchase price. The buyer then makes monthly payments for a specified term at a set interest rate. But unlike mortgage buyers, buyers who use a land contract do not legally own their homes until they make their final payment, putting them in a precarious financial and legal position in which they have all the obligations of a homeowner without the legal protections that come with mortgage-financed ownership.

Research shows that land contracts often expose homebuyers to significant risks. For example, Pew’s 2022 survey of land contract users found that these arrangements sometimes contain balloon payments—large one-time payments at the end of the loan term, which borrowers often struggle to make.2 Most land contracts also require buyers to pay for home repairs and property taxes even though they don’t legally own the property. Further, a review of state land contract laws found that many states do not require sellers to publicly record their agreements, creating a risk that a seller might try to sell the home to someone else and making it challenging for local governments to verify a buyer’s ownership stake.3 And in many cases, land contract buyers do not receive the same foreclosure protections as mortgage buyers, further imperiling their financial interest in the property.

Facts about Washington’s land contract market

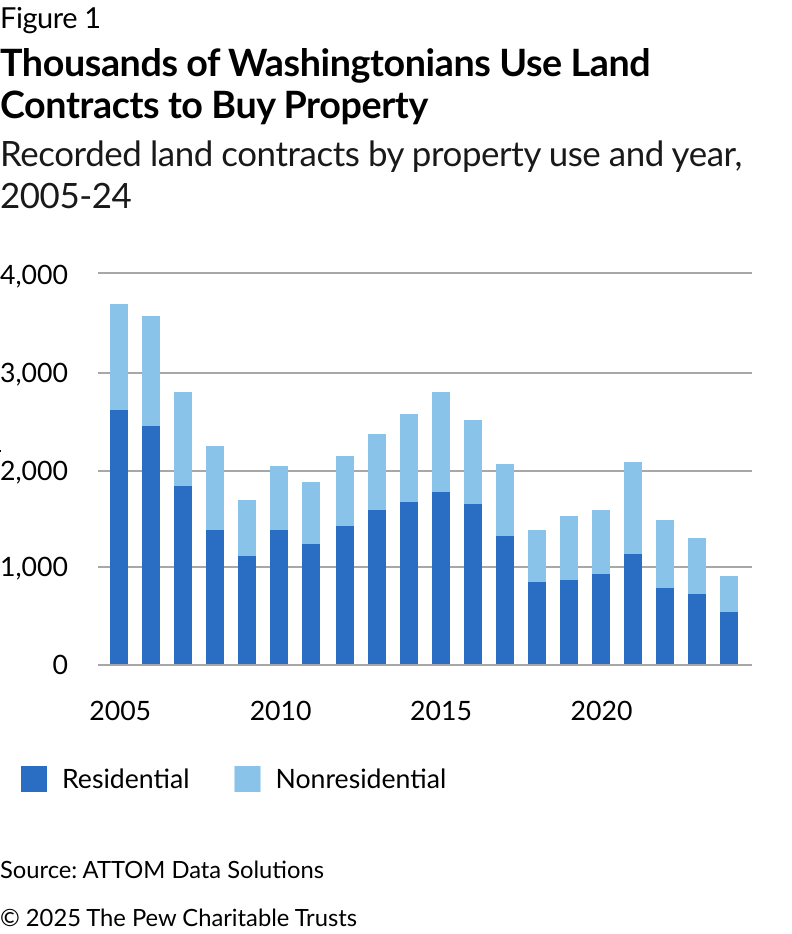

Land contracts are common in Washington. From 2005 to 2024, county governments in Washington recorded 42,442 land contracts—the fifth-most of any state. Of those contracts, 27,102 (64%) were used to acquire homes and other residential properties, while the remainder financed businesses, farms, or vacant land. (See Figure 1.) The number of recorded land contracts in Washington peaked at 3,700 in 2005. Recordings have declined markedly in recent years, to a 20-year low of 909 in 2024.

Land contracts are more common in rural areas of Washington. Although a significant number of land contracts were recorded in Washington’s largest cities, they were more prevalent in rural communities: 28% of residential land contracts (but only 11% of home sales) were recorded outside a metropolitan statistical area. (See Figure 2.) At one extreme, rural Okanogan County, near the Canadian border, recorded 1,778 residential land contracts from 2005 to 2024, representing 10.6% of all home sales. In contrast, King County (which contains Seattle) recorded 881 residential land contracts over the same period, accounting for just 0.1% of sales.

Purchasers often use land contracts to acquire low-cost homes. Among residential land contracts, 38% were used to purchase homes that cost less than $150,000 (inflation-adjusted to 2024 dollars). But just 6% of home sales statewide were for less than that amount. Overall, the inflation-adjusted median sales price of a home financed with a land contract was $198,870, substantially lower than the statewide median of $520,216.

Land contracts often finance manufactured homes. Nearly 15% of recorded residential land contracts in Washington from 2005 to 2024 were used to purchase manufactured homes, even though just 4% of home sales statewide were manufactured homes.

Land contracts are often used to finance smaller, older homes. The median year of construction for a home purchased with a land contract in Washington was 1968, making these homes notably older than the statewide median of 1984. The typical home purchased with a land contract was just 1,416 square feet, compared with 1,870 square feet for the typical home sold in Washington between 2005 and 2024.

Most land contract sales do not involve corporate buyers or sellers. Just 17% of land contract sellers and 13% of land contract buyers were corporate or business entities, with the remainder being individuals. Among all real estate transactions in Washington from 2005 to 2024, 25% involved a corporate seller and 11% involved a corporate buyer.

Land contracts are more expensive than mortgages. Land contracts carried a median interest rate of 6%, compared to 5.4% for mortgages. However, down payments were smaller: 12.2% of the total sales price for residential land contracts, compared with 20% for mortgage-financed home sales. For some land contract buyers, the relatively small down payment is part of the appeal of a land contract.

Facts about Washington’s land contract laws

Sellers have an incentive to record land contracts in Washington, but they are not required to do so. When buyers do not make all necessary payments, sellers typically prefer to pursue a real estate forfeiture, which quickly and completely cancels a buyer’s rights to the property. But Washington law requires sellers to record land contracts with local governments in order to pursue a forfeiture.4 Sellers who fail to record a contract must instead go through more time-consuming and borrower-friendly foreclosure proceedings.

Buyers have 90 days to catch up on missed payments before sellers pursue forfeiture. This provision gives buyers time to “cure” their contract and ensures that they aren’t swiftly removed from their homes if they miss a single payment.

Washington’s land contract protections only apply to homes owned as real estate. Many manufactured homes are titled as personal property—much like a car—rather than real estate, which would exclude buyers from the few consumer protections available under Washington law.5

Endnotes

- Washington State Legislature, Real Estate Contract Forfeitures, Chapter 61.30 RCW (1985), https://app.leg.wa.gov/rcw/default.aspx?cite=61.30.

- Adam Staveski, Linlin Liang, and Tara Roche, “Land Contracts Pose 5 Major Risks for Homebuyers,” The Pew Charitable Trusts, 2024, https://www.pew.org/en/research-and-analysis/issue-briefs/2024/07/land-contracts-pose-5-major-risks-for-homebuyers.

- National Consumer Law Center, “Summary of State Land Contract Statutes,” 2021, https://www.pew.org/en/research-and-analysis/white-papers/2022/02/less-than-half-of-states-have-laws-governing-land-contracts.

- Washington State Legislature, Chapter 61.30 RCW.

- Washington State Legislature, Mortgage Insurance, Chapter 61.10 RCW (1998), https://app.leg.wa.gov/rcw/default.aspx?cite=61.10.