With U.S. Electricity Demand Set to Skyrocket, the Call for Solutions Accelerates

Recent report shows potential rate hikes, the need for new power generation, and other effects of increased demand

The overall demand for energy from the electric grid in the United States, also known as “load,” is projected to increase 25% by 2030 and 78% by 2050, according to a new report by consulting firm ICF. After over a decade of minimal change, this growth is due to a combination of transportation- and building-sector electrification, the power needs of data centers for artificial intelligence and cloud services, and industrial manufacturing.

To help manage this increase—while keeping energy costs down and reliability high for customers throughout the U.S.—governments and utilities will need to make significant upgrades to the grid and scale innovative energy technologies.

The overall demand for electricity from the grid in the United States, also known as “load,” is projected to increase 25% by 2030 and 78% by 2050, according to a new report by the consulting firm ICF.

Potential customer impacts

In the report, ICF analyzed four utilities across the country and projects that residential electricity rates for consumers will increase 15% to 40% by 2030, compared with 2025 rates. DTE Energy customers in Michigan, for example, may see an increase from just over 20 cents per kilowatt hour (kWh) in 2025 to nearly 30 cents per kWh in 2030. By 2050, electricity rates could double for some utilities.

Regionally, the increase in demand is expected to vary throughout the country. For example, the Intermountain West is expecting relatively modest overall and peak electricity demand growth through 2035. By contrast, Virginia, North Carolina, Georgia, and Texas expect high growth in total electricity demand.

Reliability at risk

Utilities reliably operate the grid by always having more electricity available than they’ll need to meet peak demand—an excess called the “reserve margin.” Reserve margins vary by region but are typically 15%-20% of peak demand. However, many parts of the U.S. will experience below-target reserve margins as soon as 2030, according to the report. And without new resources—such as solar and batteries—for utilities to tap into, new interconnection requests from growing industries, including data centers, may be denied.

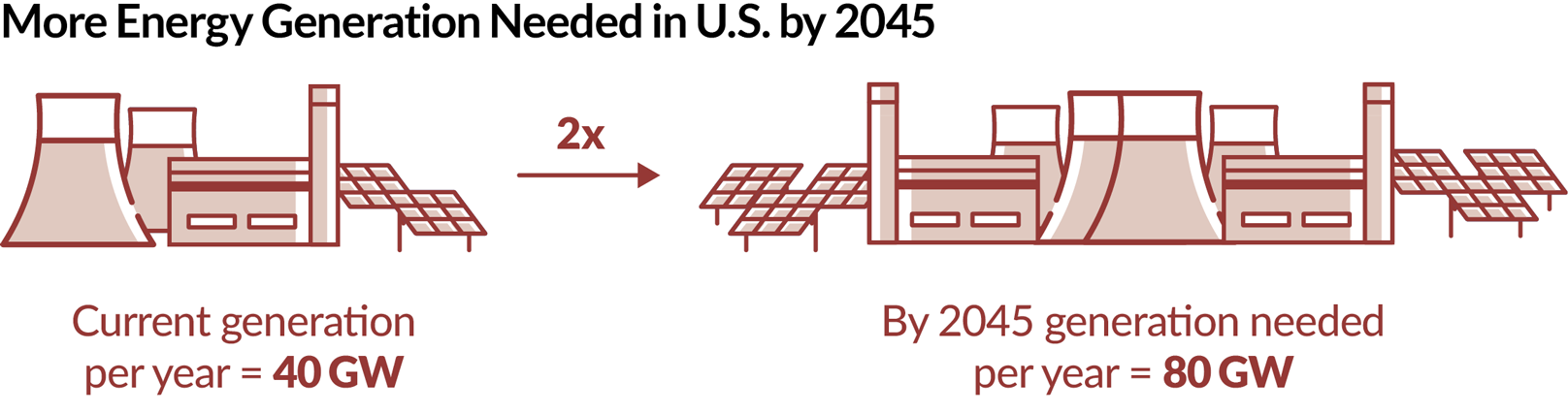

New generation is needed

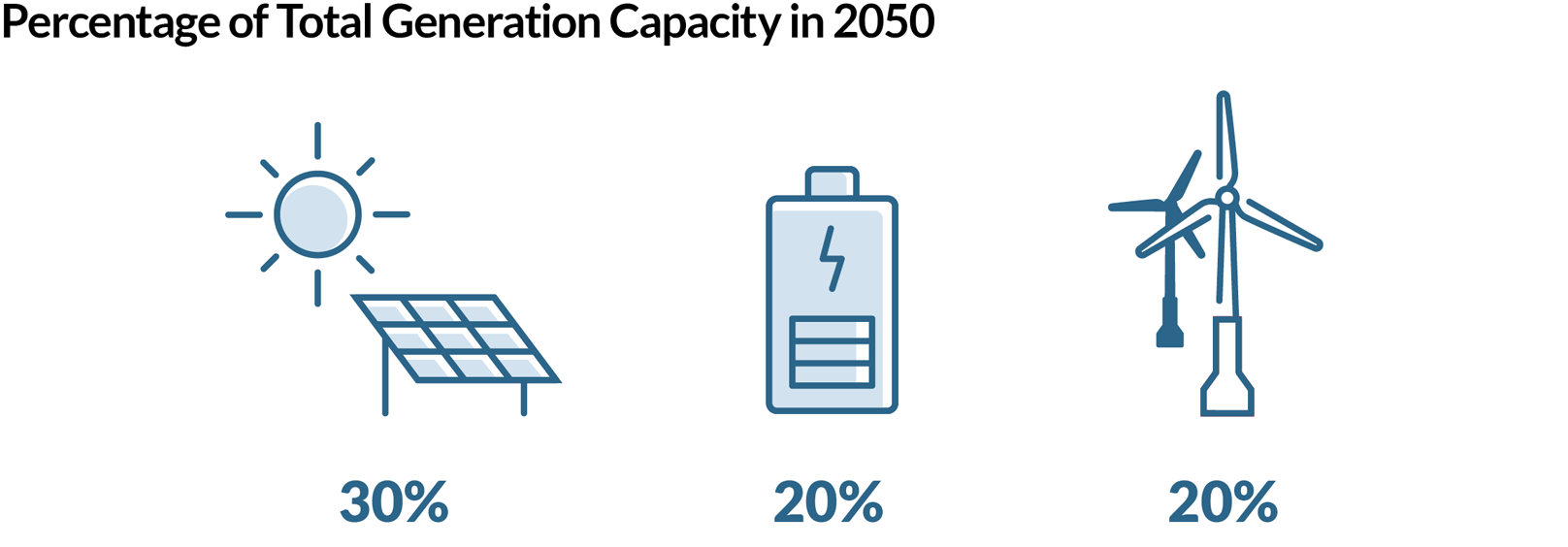

To meet the growing electricity demand, the U.S. will need to build about 80 gigawatts (GW) of additional capacity per year over the next 20 years. That’s up from the 40 GW average of new capacity built annually over the past five years. ICF modeled the types of energy generation resources likely to be built in the future, leveraging data from the U.S. Energy Information Administration. The report shows that new solar, wind, and battery storage are projected to be installed more than any other types of generation by 2050. Specifically, ICF forecasts that solar will make up around 30% of that new capacity, battery storage will be around 20%, and onshore wind just under 20%. The remaining 30% of new capacity would come from a mix of natural gas, offshore wind, nuclear power, and other resources.

Adding new generation quickly can be a challenge, hindered by supply chain constraints and efforts to make necessary upgrades to transmission and distribution systems. Nevertheless, utilities, grid operators, and local governments are looking to offset the growth in electricity demand by improving how they manage load through solutions like rooftop solar and battery storage—technologies that can generate and deliver energy on site. Other approaches to enhance load management include employing demand response programs – voluntary incentive programs that reduce or shift a customer’s electricity usage during peak periods – and promoting energy efficiency. The report notes that advancing these programs could help meet over 10% of the national peak electricity demand by 2030.

Fortunately, many states, localities, utilities, and grid operators are working on solutions—including distributed energy resources and advanced transmission technologies (ATTs)—to modernize the energy grid. Indiana and Utah are among the states advancing ATT solutions, with each state recently passing laws encouraging ATT deployment to enable their transmission system to deliver more power to customers, including through new generation. Energy researchers are also exploring how new data centers can operate more flexibly to ease the strain on the grid.

With energy demand set to grow rapidly in the U.S., it’s critical that governments and utilities adopt pragmatic and affordable solutions and scale them as fast as possible to reduce the burden on the grid and deliver benefits to consumers.

Brian Watts is an officer and Maureen Quinlan is a senior officer with The Pew Charitable Trusts’ energy modernization project.