1 Million Workers Have Saved $2 Billion in State Automated Retirement Savings Programs

Five programs launched since early 2024; two expected in 2025

This piece was updated on Aug. 18, 2025, to reflect that states in red on the map have not considered legislation in 2025.

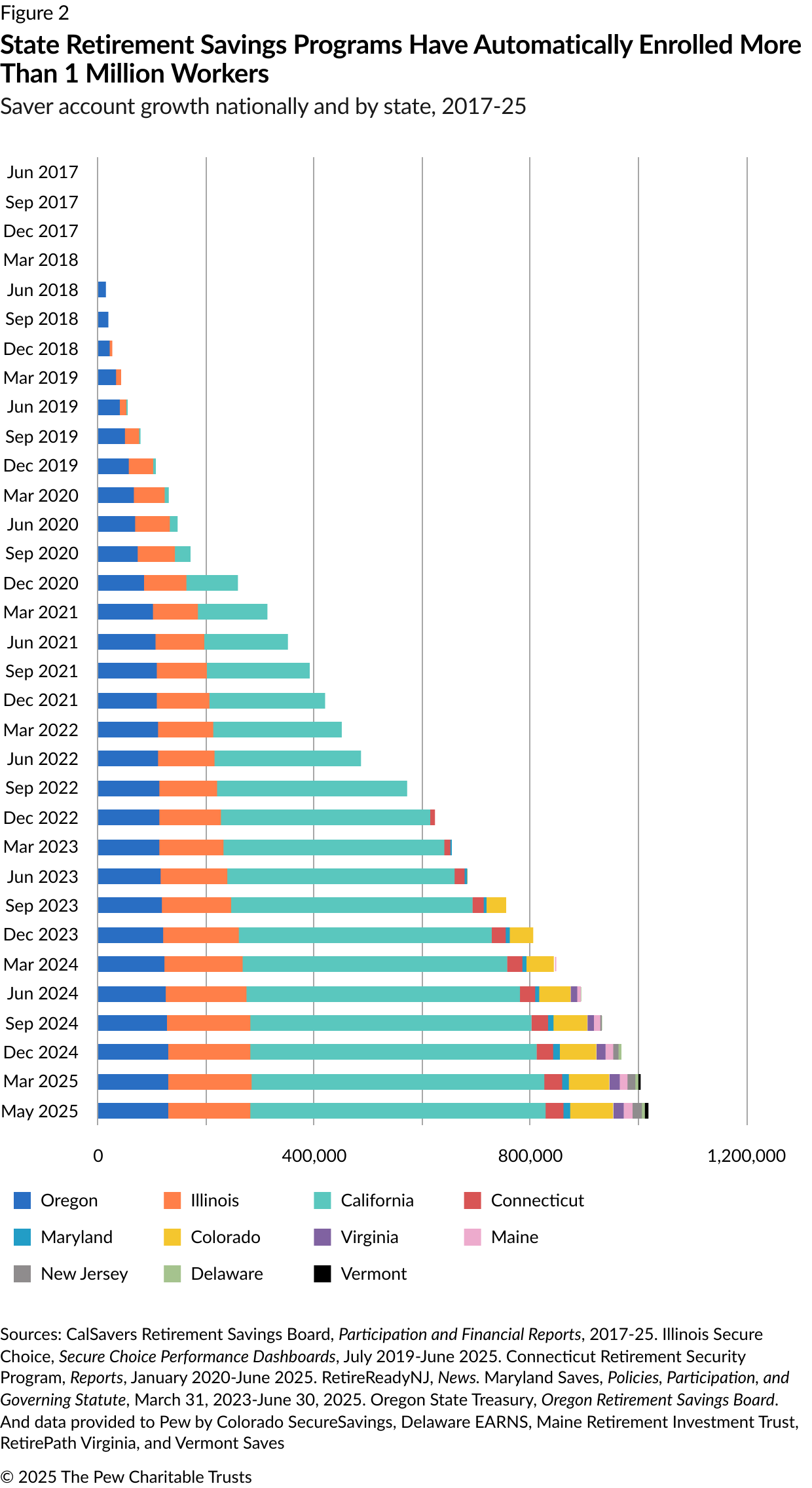

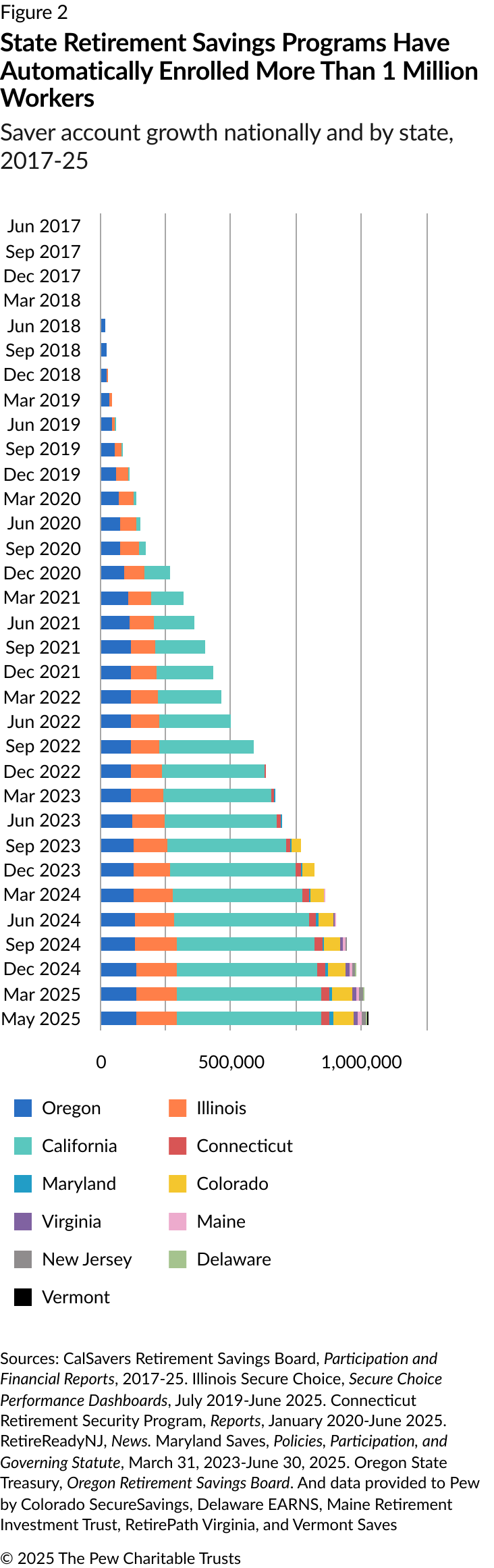

Private sector workers in 12 states have a major new milestone to celebrate: Together, more than a million of them have now set aside over $2 billion for retirement in state automated savings programs. Designed to help workers who do not have access to employer-sponsored retirement plans, the savings programs—often called “auto-IRAs”—automatically deposit a small portion of each paycheck into an individual retirement account managed by a private financial services firm with state oversight.

Research shows that people are far more likely to save for retirement if they can set aside money automatically, through payroll deductions. But many small businesses don’t offer retirement benefits, which means that more than 56 million workers—nearly half the private sector workforce nationwide—don’t have access to retirement benefits at work.

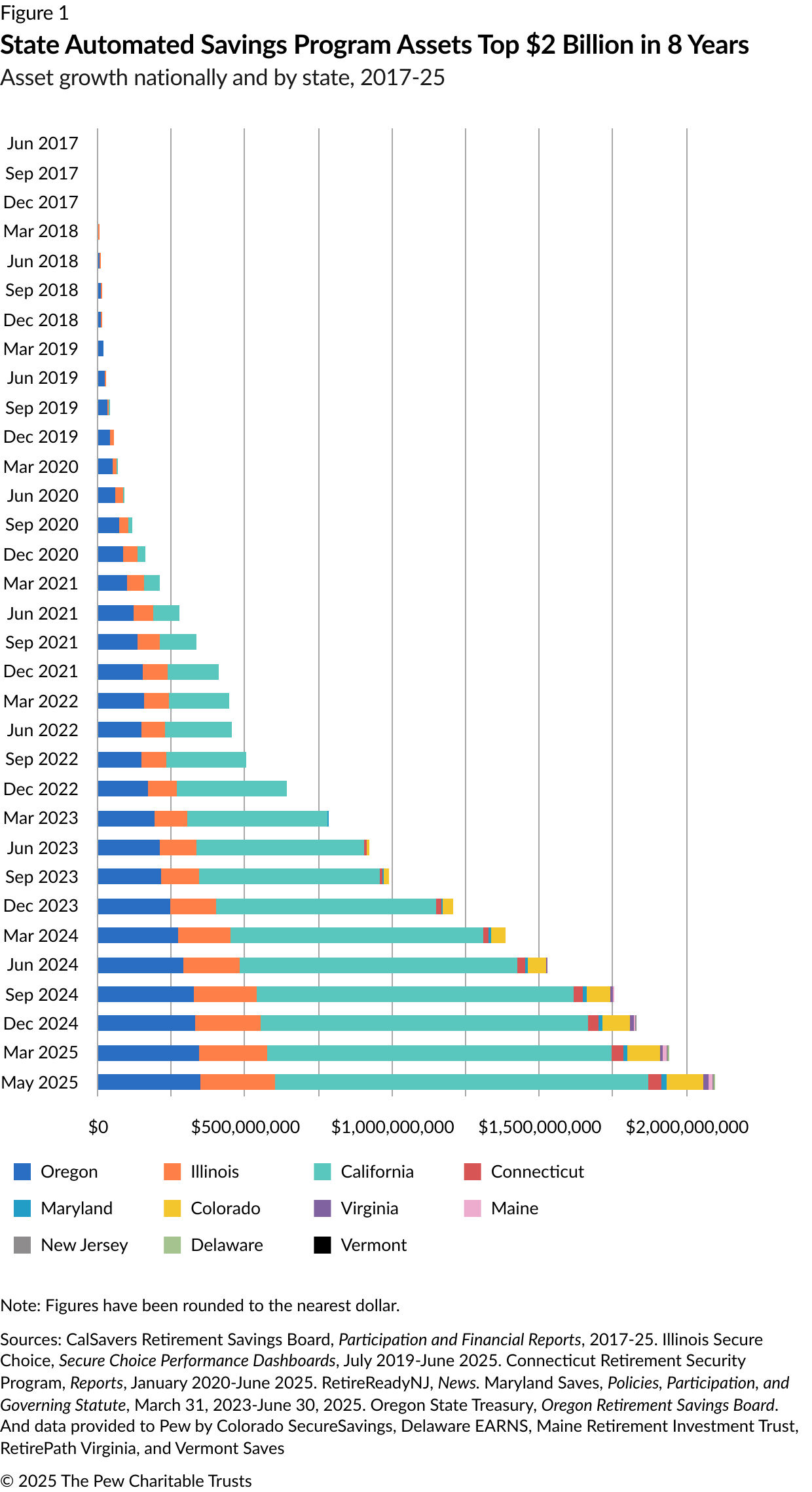

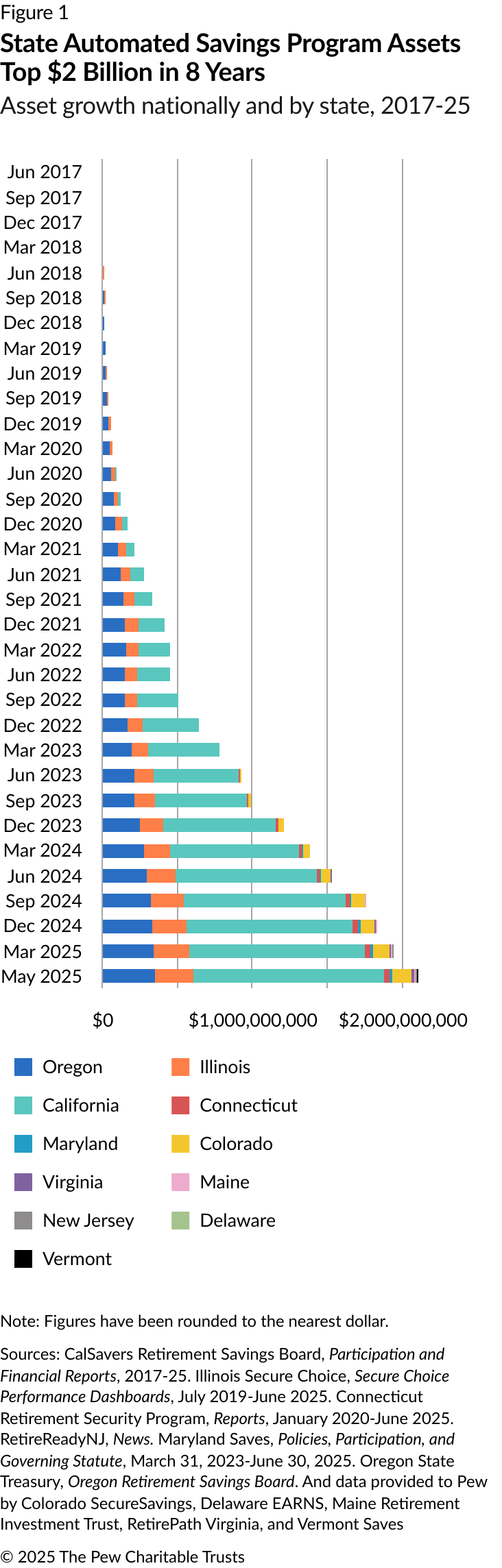

Since Oregon established the first state automated savings program in 2017, saver and employer participation numbers have steadily increased, and assets have experienced dramatic growth. It took six years for state programs to amass their first billion dollars. Those assets doubled to $2 billion in just 18 months. This rapid growth stems from better-than-average market performance, a 25% increase in saver accounts, and higher average savings rates as programs mature.

In addition, new states are coming online at a faster pace than in the past. In the six years after Oregon launched its program, only six states—California, Colorado, Connecticut, Illinois, Maryland, and Virginia—followed suit. But in 2024 alone, four new states debuted programs—Delaware, Maine, New Jersey, and Vermont. Nevada became the 12th state to offer a savings program in June 2025.

Employers, particularly small businesses in high-turnover industries such as leisure and hospitality, have historically struggled to provide retirement benefits to their employees. The state programs aim to fill this gap by providing a no-cost option for employers that lack the time or resources to set up a private retirement savings plan. More than 250,000 businesses have now registered. Meanwhile, tens of thousands more have chosen to set up their own 401(k) or other qualified plan for employees.

Partnerships expand, make it easier for states to establish new programs

The explosive growth of auto-IRAs has sparked innovation, making it easier for new states to begin programs. In 2023, Colorado SecureSavings created the “Partnership for a Dignified Retirement,” an interstate consortium of automated savings programs that helps states reduce administrative costs and accelerate the implementation process. By using the Colorado program’s established partnership agreement, other states avoid lengthy request-for-proposal and contracting processes, in some cases cutting in half the time necessary to take a program from signed legislation to statewide launch. Last year, three states joined Colorado in the partnership—Maine, Delaware, and Vermont. Their combined assets already exceed $144 million from more than 100,000 savers in just two years. Nevada and Minnesota joined this year, bringing the number of states in the partnership up to six.

On the East Coast, Rhode Island’s nascent RISavers program has signed a partnership agreement with the MyCTSavings program in neighboring Connecticut. Whereas Connecticut took several years to get its program up and running, Rhode Island passed legislation in June 2024 and plans to launch its savings program later this year. These partnerships prove that states can establish a retirement program quickly, providing residents with access to retirement savings accounts in a relatively short period of time. Partnerships can also help smaller states, which have relatively few participants, secure a financial services firm to serve as program administrator. Additionally, over time, these partnerships will be able to leverage their cumulative assets under management to reduce costs for savers across all partnership states.

Four other programs also on the horizon; 10 bills considered this year

More state savings programs are on the way. After years of planning, New York is actively recruiting pilot employers for the New York Secure Choice Savings Program (SCSP) and will be the next to launch after Rhode Island, in late 2025. More than half of New York’s private sector employees—nearly 3.5 million people—don’t have access to a retirement savings plan at work. Early estimates suggest that the SCSP could provide access to retirement savings accounts for over a million workers.

Hawaii first passed legislation to create an automated savings program in 2022, but program implementation stalled because the original statute lacked automatic enrollment for employees, which is a necessary feature to secure a program administrator. Over the past six months, the program has hired an executive director, and the Legislature amended its statute to add automatic enrollment. The Hawaii Retirement Savings Program is now on track for a 2026 or 2027 launch.

Two more state programs—Minnesota and Washington—are also in development. Legislation for the Minnesota Secure Choice Retirement Program passed in 2023. In June, the program’s board voted to join the Partnership for a Dignified Retirement, which will allow the program to launch in early 2026. Washington Saves hired an executive director in late 2024 and will soon begin the process of implementation outlined in its statute, with a likely launch in 2027.

Ten other states also considered automated savings program legislation in 2025: Alaska (SB 21), Arizona (HB 2903), Arkansas (HB 1335), Georgia (SB 226), Indiana (SB 0513), Massachusetts (SB 1770/HB 2318), Mississippi (HB 345), Pennsylvania (HB 1263), Tennessee (HB 0017), and West Virginia (HB 4926). The bills in Pennsylvania and Massachusetts, which have two-year legislative sessions, remain active.

The goal of state savings programs has always been to increase retirement savings access for as many workers as possible, whether through the programs themselves or by encouraging employers to establish their own retirement savings plans. For states, that will translate to billions of dollars in savings because of reduced costs for social services. For employers, it provides a valuable tool to recruit and retain their workforce. And, for the 1 million American workers who helped state programs achieve the $2 billion milestone, automated savings programs could help secure a comfortable retirement.

Kim Olson works on The Pew Charitable Trusts’ retirement savings project.