How Americans Pay for Their Homes

Millions of homebuyers rely on alternative financing when mortgages are unavailable

Most Americans buy their homes using mortgages, but millions take different approaches. Some pay with cash, others inherit properties from family members, and still more use alternative financing arrangements. Alternative financing is often used by homebuyers who are unable to get a mortgage, either because their property does not qualify for a standard loan or because a shortage of small mortgages makes it difficult for them to access financing. Instead, these buyers turn to alternatives that can be risky and costly, with few consumer protections.

From lease-purchase agreements to land contracts, an estimated 3.4 million households used alternative financing arrangements in 2021. The arrangements were most common among buyers of low-cost homes, rural properties, manufactured homes, and units in multifamily buildings. For some of these buyers, alternative financing is a lifeline that enables them to live in the home and neighborhood of their choice, even when they can’t get a mortgage. But others never attain homeownership, instead signing complicated contracts containing risky terms that can lead to serious financial harm.

To better support Americans on their path to homeownership, federal policymakers should focus on areas where the current mortgage market is falling short. In parts of the housing market where alternative financing is common, government officials should consider strategies that expand the supply of mortgages. They should also encourage the design of new products and adoption of policies that can help to meet consumer demand in these markets while improving protections for buyers using alternative financing.

Millions of households use alternative financing

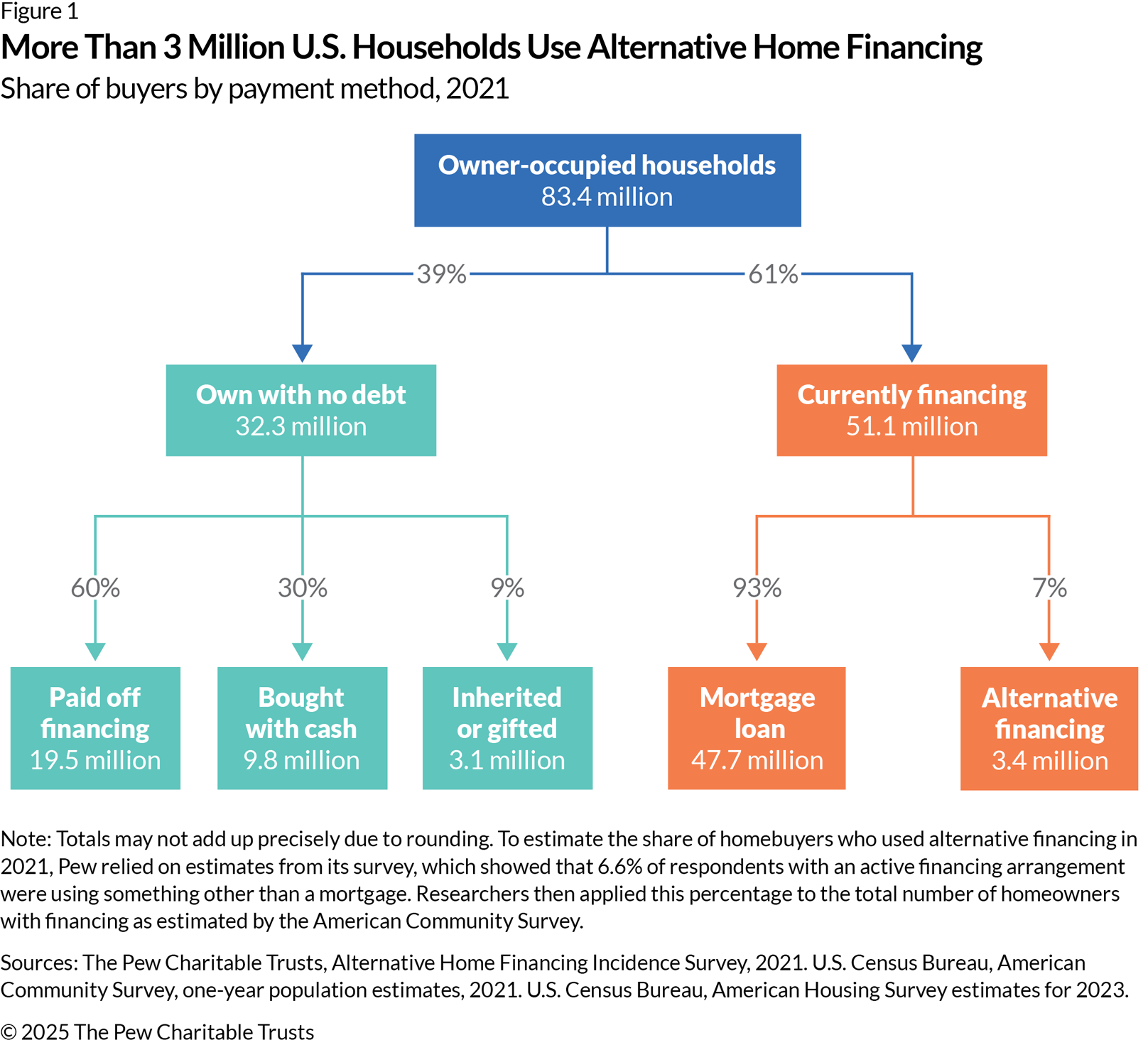

About 83 million U.S. households owned or were in the process of buying a home in 2021. Some of those households—about 32 million—owned their homes with no debt. That includes those who had paid off their mortgage or other financing arrangement (60%), those who bought their homes with cash or equity from a previously purchased home (30%), and those who received their homes through inheritance or as a gift (9%).

The remaining 51 million homeowners were paying off some type of financing. Most (93%) were paying off a mortgage. But an often-overlooked minority—nearly 7%—were using some form of alternative financing—a term that describes arrangements that do not qualify as traditional mortgages and are typically between the seller or buyer. These include lease-purchase agreements, land contracts, seller-financed mortgages, and personal property loans for manufactured homes. (See Figure 1.) This corresponds to about 3.4 million households using alternative arrangements in 2021.

Lease-purchase agreements were the most common type of alternative financing, with an estimated 1.07 million households using one of these arrangements in 2021. Personal property loans (870,000), seller-financed mortgages (730,000), and land contracts (610,000) were also common. However, these alternative financing arrangements were not equally common in all housing markets and tended to pop up most frequently in communities—and for housing types—where mortgages were scarce.

Mortgages are often not available for low-cost homes

One of the clearest patterns is how borrowers pay for low-cost versus higher-cost homes. About 17% of those seeking to purchase properties valued under $200,000 used some form of alternative financing, nearly five times the rate seen among borrowers purchasing higher-cost homes (3.8%). (See Figure 2.)

Research shows that small mortgages—loans for less than $150,000—are hard for borrowers to get. Lenders often report that such loans are unprofitable to originate because of the high fixed cost of origination, commission-based loan officer compensation, the poor physical quality of many low-cost homes, and the complexity of compliance rules. These challenges help explain why 38% of lenders did not issue a single small mortgage from 2018 to 2021 and why banks have retreated from mortgage lending over the past two decades. As a result, many homebuyers who could qualify for a small mortgage instead have to forgo homeownership or use alternative financing.

Rural homebuyers struggle to access mortgages

Rural homebuyers make up a small share of the national market for home purchases, but they are disproportionately likely to use alternative financing arrangements. Pew’s survey found that 9.8% of rural borrowers were using something other than a mortgage in 2021, compared with 6.1% of urban borrowers. Land contracts were especially common in rural areas; 25% of such contracts originated outside metropolitan areas from 2005 to 2022.

The lack of small mortgages is particularly acute in rural areas for three reasons. First, rural areas are more reliant on small mortgages, which lenders struggle to profitably originate. Second, rural housing stock is older and more dilapidated than that in urban and suburban areas, and existing types of financing are poorly suited to handle home repair needs. Third, many rural homebuyers have low or no credit scores, which can make lenders hesitant to extend them credit. For many buyers with low credit scores and those seeking a fixer-upper, alternative financing may be the only option.

Manufactured homes often do not qualify for mortgages

Manufactured home buyers account for a large share of those using alternative financing because they are the only buyers who qualify for personal property loans—a type of financing that covers only the structure and not the land beneath it. Data from the U.S. Census Bureau shows that over 75% of new manufactured home shipments are titled as personal property, which disqualifies them from mortgage access and forces prospective buyers to pay for their homes in cash or by using alternative financing.

But even excluding personal property loans, manufactured home buyers use alternative financing at above-average rates. Pew commissioned a survey of manufactured home buyers in 2022 and found that 20% were using an alternative financing arrangement other than a personal property loan. Usage was especially high for low-income homebuyers and those purchasing manufactured homes with significant repair needs. In both cases, borrowers’ reliance on alternative financing stems from challenges getting traditional financing: Lenders denied 40% of manufactured home mortgage applications in 2021.

Financing for multifamily homes can be complex

Financing challenges extend to homes located within multifamily buildings. An estimated 23% of borrowers living in duplexes or condominiums used some form of alternative financing in 2021—far exceeding the 3% of buyers of site-built single-family homes who use something other than a mortgage. Data suggests that lenders are less willing to issue mortgages for multifamily units: From 2018 to 2023, applications for homes in multifamily buildings were denied 17% of the time, compared with 9% for site-built single-family homes. This problem occurs in part because the viability of each condo loan affects the collective financial well-being of the entire building, and that introduces unique risks that lenders must evaluate.

Further, lenders report several risks to issuing mortgages in multifamily buildings. For one, lenders find it difficult to assess the financial stability of a building’s homeowners’ association and believe that multifamily buildings are more likely to have deferred maintenance that is not fully captured through standard inspection or appraisal processes. Likewise, lenders report that loans for condominiums often fall outside the scope of common automated underwriting systems, raising the cost of issuing such loans. And, although a 2023 survey found that 95% of lenders issued a condo loan over the preceding 12 months, more than three-quarters reported that those loans made up less than 10% of total loan volume.

Implications for policy

The widespread use of alternative financing highlights the limitations of the mortgage market. Millions of Americans want to buy affordable site-built and manufactured homes but struggle to find lenders that issue small mortgages. When mortgages are hard to get, buyers turn to alternative financing. Although many people report good experiences with this form of credit, the reality is that buyers often lack critical consumer protections—such as clear disclosures, foreclosure protections, and the right to refinance—and pay high costs.

Improving access to well-designed credit products will require state lawmakers to modernize their alternative financing laws. As a start, they can look to existing practices offered by a wide range of sellers—from regional companies to individual operators and nonprofit organizations. The most successful models are those that are financially viable for the seller but also offer buyers a clear, predictable path to homeownership. At a minimum, policymakers should require sellers to publicly record their alternative financing arrangements, provide buyers with written contracts, and restrict their ability to include risky contract terms and excessive fees.

Policymakers also should take steps to expand access to traditional mortgages. For example, state policymakers could reform titling laws to allow more manufactured homes to qualify for such mortgages. Likewise, Fannie Mae and Freddie Mac, the government-sponsored enterprises that play a large role in the housing market, could focus on purchasing more new and existing small mortgages in rural and other underserved communities to increase liquidity and encourage new lending. Finally, federal policymakers could continue to foster the use of cash flow underwriting— which evaluates a borrower’s income, expenses, and transaction history—and can be more accurate for some homebuyers than standard credit-score-based underwriting alone. That approach enables more borrowers with nontraditional employment (many of whom live in rural areas) to access financing. Together, these policies could help more Americans achieve homeownership, build wealth, and remain stably housed in their communities.

Tara Roche is a project director and Adam Staveski is a principal associate with The Pew Charitable Trusts’ housing policy initiative.