Federal Share of State Budgets Remains High, But Uncertainties Lie Ahead

The share of states’ total revenue coming from federal funds stayed near record highs in fiscal year 2023, bolstered by ongoing pandemic aid, infrastructure funding, and a slowdown in state tax collections. Although federal funding began to taper slightly, a larger drop in state tax revenue offset that decline—resulting in a modest dip in the federal share. Looking ahead, the share is likely to remain elevated through fiscal 2024, but growing uncertainties around federal policy and funding could shift that trajectory in future years.

Trends in federal funding

In fiscal 2023, federal dollars accounted for 36% of total state revenue. This marks the second year of a slight decline, down from 36.4% in fiscal 2022 and a record 36.7% in fiscal 2021. Despite the incremental drop, the federal share remained well above pre-pandemic levels, reflecting the continued influence of historic federal support during and after the COVID-19 recession.

In fiscal 2023, despite falling by $16.8 billion—or about 1.5%—compared with the year before, total federal grants to states topped $1 trillion, just shy of the record high set in fiscal 2022. Meanwhile states’ general revenue, which includes taxes and service charges, dropped by $8.4 billion. As a result, the federal share of total state revenue declined.

Even though states brought in record amounts of revenue from service charges, local sources, and other miscellaneous streams, those gains were overshadowed by a $52 billion—or 3.5%—drop in tax collections, the largest single revenue source for most states. This largely reflects the unwinding of multiple one-time and temporary factors that helped to bolster state tax collections since the pandemic’s onset.

Historically, the federal share of state revenue has ranged from about a quarter to a third. Before the pandemic, the highest share occurred just after the 2007-09 Great Recession , when a temporary influx of federal dollars and falling state tax revenue pushed the federal share to 35.5% in fiscal 2010 and 34.7% in fiscal 2011. The fiscal 2023 share was 2.7 percentage points higher than the 15-year average of 33.3% from fiscal 2009 to 2023, and 7.9 percentage points higher than the 50-year average of 28.4% from fiscal 1974 to 2023.

In the period between the 2007-09 recession and the COVID-19 pandemic, Medicaid was a major driver of the long-term growth of the federal share because of states’ participation in Medicaid expansion under the Affordable Care Act as well as an overall increase in Medicaid enrollment. As of April 2025, 40 states and Washington, D.C., had adopted the expansion.

The federal share of state revenue reflects how much funding states receive from the U.S. government to help pay for public services, such as health care, education and training, transportation, and infrastructure. The indicator measures the combined effects of swings in state and federal funds. A higher or lower percentage does not necessarily indicate a problem for state budgets.

Nationwide, states received 58.4% more in federal grants in fiscal 2023 than they did just before the pandemic in fiscal 2019—ranging from a 122.5% increase in Oklahoma to a 33.9% increase in California. The federal government enacted six laws during the pandemic that together awarded states more than $800 billion in COVID-19 relief, much of which began to wind down starting in fiscal 2023.

Fiscal 2023 also marked the second year that states were eligible for the more than $760 billion authorized through the Infrastructure Investment and Jobs Act and the Inflation Reduction Act. Together, these funds are likely to keep federal grants to states elevated as pandemic aid expires.

State highlights

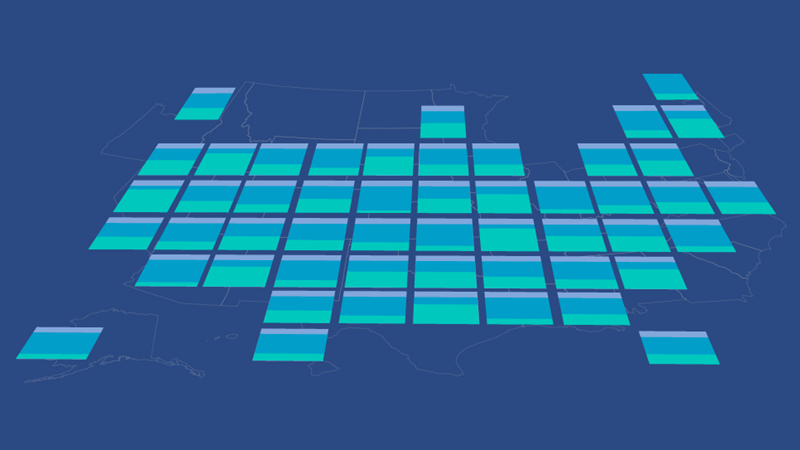

Federal shares vary across the country. Fiscal 2023 data shows that:

- Louisiana reported the highest percentage of revenue from federal funds for the second consecutive year (50.1%).

- Hawaii reported the lowest percentage (24.1%).

- The percentages of revenue from federal funds in states with the largest federal shares—Louisiana (50.1%), Arizona (48.8%), and Wyoming (46.1%)—were roughly double that of states with the lowest shares: Hawaii (24.1%), Kansas (27.2%), and North Dakota (27.3%).

- In 13 states, federal funds—rather than state tax dollars—were the largest source of revenue in fiscal 2023, which is down from 16 states in fiscal 2022, but still higher than five states in fiscal 2019. The peak was in fiscal 2020, when federal funds made up the largest share in 18 states, the most on record.

- Four states—Colorado, New Jersey, Oklahoma, and Pennsylvania—reported their largest shares of revenue from federal funds of any year in the past 50 years, down from 20 states that reported the same in fiscal 2022.

- North Dakota experienced the biggest annual percentage-point growth in the federal share of state revenue, up 5.2 percentage points from fiscal 2022. This swing was driven by the combination of a sharp increase in federal revenue and a similarly stark decline in state own-source revenue: Federal funds to the state grew by 14%, while state own-source revenue fell by 7.3%—largely because of a reported decline in interest earnings.

- South Dakota experienced the biggest annual percentage-point decline in its federal share, which fell by 9.3 percentage points from fiscal 2022, driven by a nearly 27% decrease in federal funding, coupled with an increase in every other revenue type.

Federal funds compared with other revenue sources

Federal dollars remained the second-largest source of state revenue in fiscal 2023, totaling almost $1.1 trillion, or 36%, of the roughly $3 trillion that state governments collected. Tax collections are states’ leading revenue generator and accounted for more than $1.4 trillion in fiscal 2023—making up 46.7% of state revenue.

Why Pew assesses the federal share of state revenue

State revenue comes from a wide range of sources, including taxes, federal funds, service charges, local funds, and miscellaneous fees. Federal funds generally make up a large proportion of overall revenue—historically ranging from about a quarter to a third. Federal grants are a key funding source for states across a wide variety of policy areas, most notably Medicaid, which accounted for 68.8% of federal grants in fiscal 2024. Income security, transportation, and education make up smaller shares. Because state and federal budgets are inseparably linked, any policy changes, major pieces of legislation, or disruptions in federal funding can affect state finances.

This link has come into sharper focus amid recent actions that raise questions about the level and stability of federal support that states can anticipate going forward. Even though some federal actions face legal challenges, the uncertainty alone can delay decisions and cloud budget forecasts.

To better manage these risks, states can use budgeting tools, particularly long-term budget assessments and stress tests, to evaluate their exposure to federal shifts, assess whether their savings are sufficient to weather short-term gaps, and map out response plans. These analyses should be updated regularly to reflect evolving fiscal conditions.

Rebecca Thiess is a manager and Samuel Pittman is an associate with The Pew Charitable Trusts’ managing fiscal risks project. Justin Theal is a senior officer with Pew’s Fiscal 50 project.