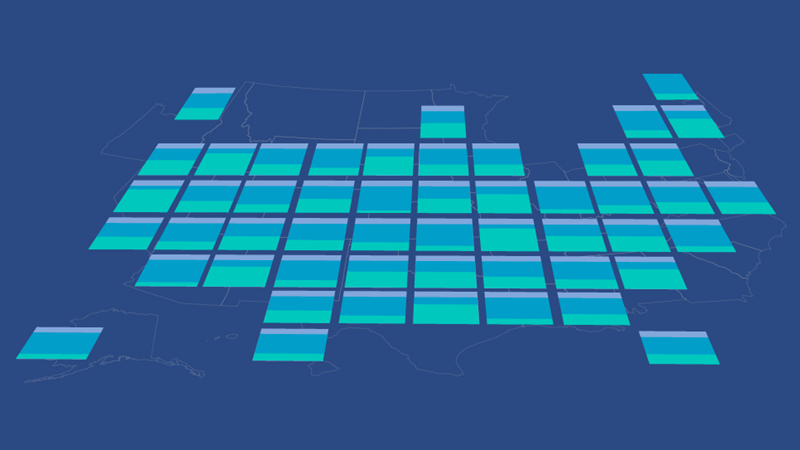

How States Raise Their Tax Dollars

FY 2019

Note: this data has been updated.

Taxes make up about half of state government revenue, with two-thirds of states’ total tax dollars coming from levies on personal income (37.9%) and general sales of goods and services (30.9%).

Broad-based personal income taxes are the greatest source of tax dollars in 30 of the 41 states that impose them, with the highest share—70.5%—in Oregon. General sales taxes are the largest source in 15 of the 45 states that collect them. Florida is the most reliant on these taxes, at 62.5%. Other sources bring in the most tax revenue in a handful of states: severance taxes in Alaska and North Dakota, property taxes in Vermont, license taxes and fees—such as franchise taxes that companies pay to incorporate in a state—in Delaware, and selective sales taxes on particular goods and services—such as tobacco and hotel rooms—in New Hampshire.

This infographic illustrates the sources of each state’s tax revenue.