For Many Student Loan Borrowers, Financial Security Feels Out of Reach

New survey shows financial hardships often linked to repayment struggles

Overview

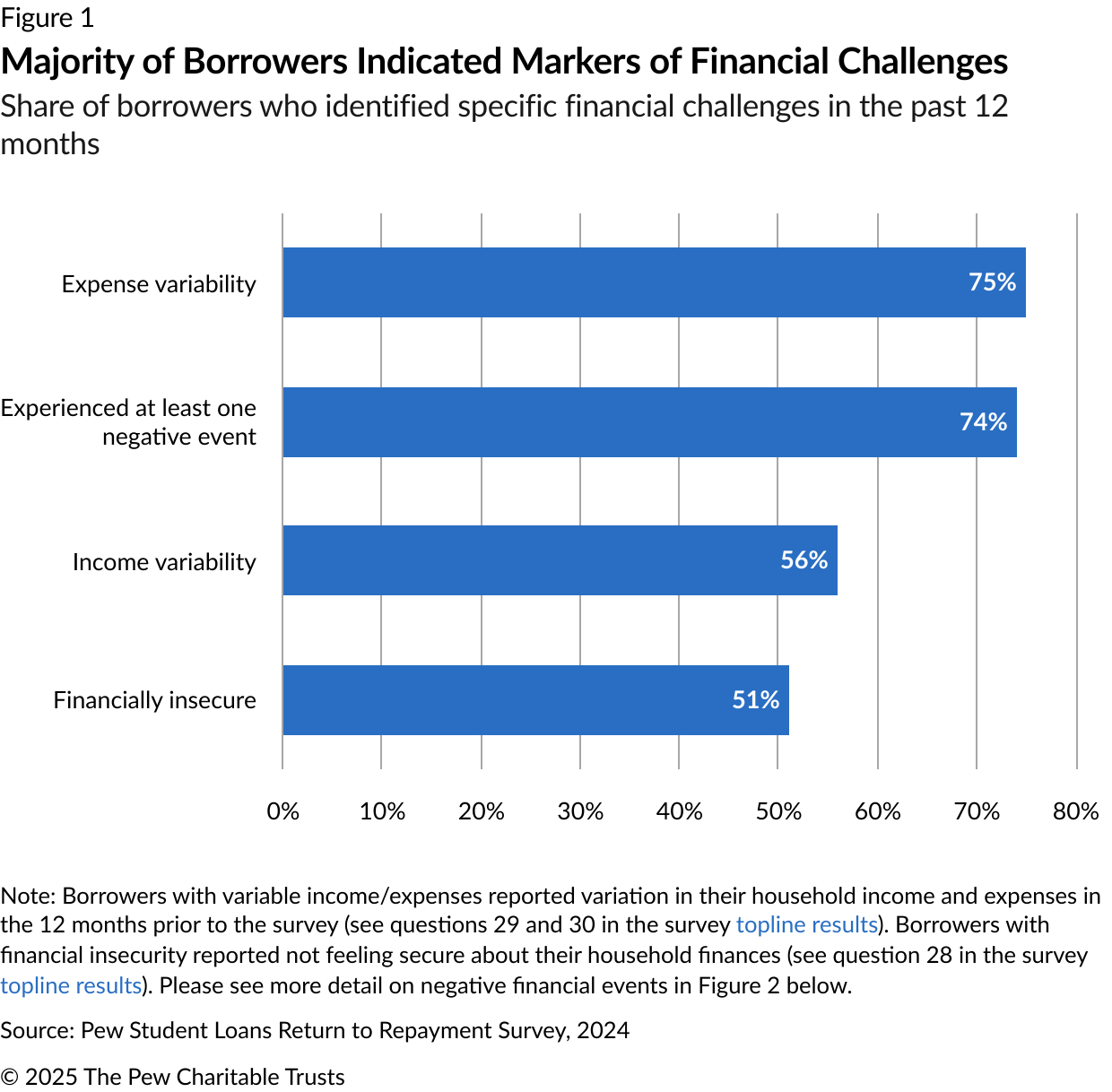

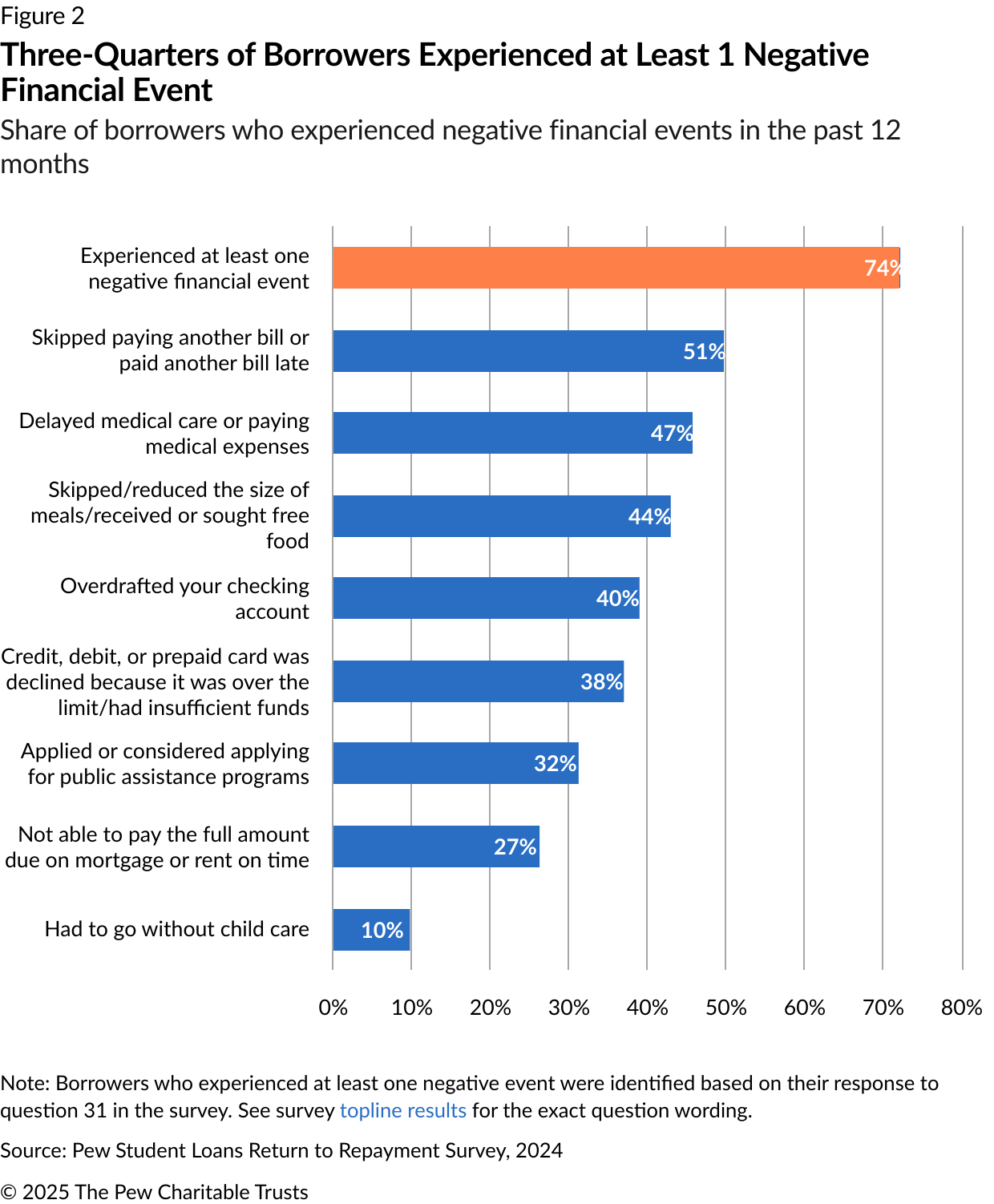

Less than a year after the October 2023 resumption of federal student loan repayments, half of student loan borrowers (51%) said they did not feel financially secure, according to new data from The Pew Charitable Trusts. In addition, an overwhelming majority (74%) of borrowers said they had experienced at least one negative financial event in the last 12 months—such as not being able to pay the full amount due on their mortgages or rents on time, overdrawing their checking accounts, or applying for public assistance programs. A significant share of borrowers reported experiencing some degree of volatility in their incomes (56%) and expenses (75%), two factors that have been associated with repayment difficulties, including higher rates of default.1

The survey shows that markers of financial distress—such as feeling financially insecure, having volatile income or expenses, and experiencing negative financial events—are associated with repayment challenges such as late, irregular, or partial payments. People who reported experiencing such financial distress also cited affordability concerns and said their student loan payments were more stressful than other bills.

In October 2023, after a payment pause of more than three years, borrowers returned to or entered a repayment system that closely resembled the one operating before the pandemic. In addition to the pandemic-era payment and interest pause, which expired in 2023, they had the benefit of the Fresh Start2 and on-ramp periods, which provided temporary protections against the consequences of nonpayment.3 Fresh Start, a one-time program from the Department of Education, allowed borrowers with defaulted loans to return to repayment without a past-due balance, and the on-ramp was a year-long period of flexibility that helped borrowers transition back into repayment. With the expiration of both of these temporary protections, borrowers who do not make payments will once again face negative credit reporting and can enter default, which may result in their wages and tax refunds being garnished.

In addition, the income-driven repayment (IDR) plans—types of repayment plans that calculate monthly payments based on a person’s income and family size and include the Saving on a Valuable Education (SAVE), Pay as You Earn (PAYE), income-based repayment (IBR), and income-contingent repayment (ICR) plans—were challenged in court. The court injunctions add another layer of confusion for borrowers reentering repayment.

The survey results show that as borrowers incorporate loan payments back into their budgets, they are juggling a host of financial challenges while navigating an uncertain student loan repayment landscape. As the Department of Education continues to implement changes to IDR plans in a time of uncertainty, it needs to provide borrowers with concrete steps to keep their loans in good standing.

Borrowers reported financial insecurity; a majority had also experienced negative events

To understand how borrowers perceive their financial state, the survey asked how they felt about household finances, and how much their household income and expenses had varied over the past 12 months.

A little over half (51%) of borrowers said they did not feel secure about their household finances. In addition, 56% of borrowers reported some degree of income variation, with 23% reporting that their household income had varied a lot over the last 12 months. An even larger share of borrowers reported that their household bills and expenses had fluctuated over the same time frame. Three-quarters (75%) reported some degree of change in expenses, with 25% of borrowers saying their expenses had varied a lot month-to-month over the last 12 months. (See Figure 1.) Variable income and expenses can make it more difficult to work recurring student loan payments into monthly budgets.

The survey also asked if borrowers had experienced any adverse events in the preceding year because of a lack of money. Respondents chose from a list of negative financial events. Nearly three-quarters of borrowers (74%) indicated experiencing at least one negative financial event. (See Figure 2.)

Among the several negative financial events borrowers faced in the 12 months preceding the survey, the most frequent event was skipped or late payments on bills other than rent or mortgage. Pew’s analysis shows that borrowers who indicated skipping or making late payments on their bills were also more than four times as likely than others to miss, make irregular payments, or make partial payments on their student loans (36% vs. 8%).

Borrowers were much more likely to report experiencing negative financial events than to identify themselves as financially insecure (74% vs. 51%). This suggests that even borrowers who consider themselves financially secure may still experience financial disturbances that can derail successful student loan repayment.

Financial difficulty across any measure can complicate repayment

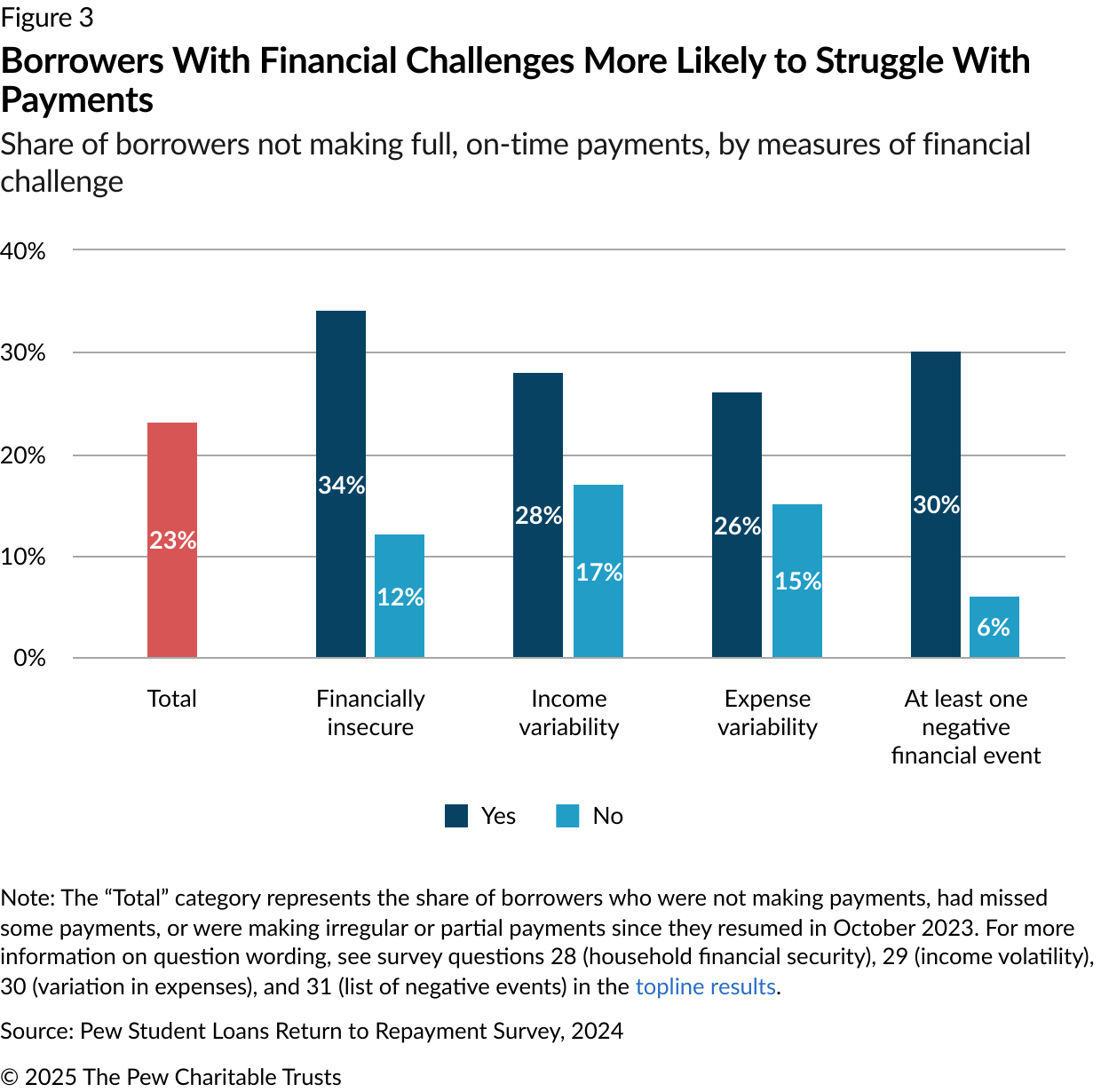

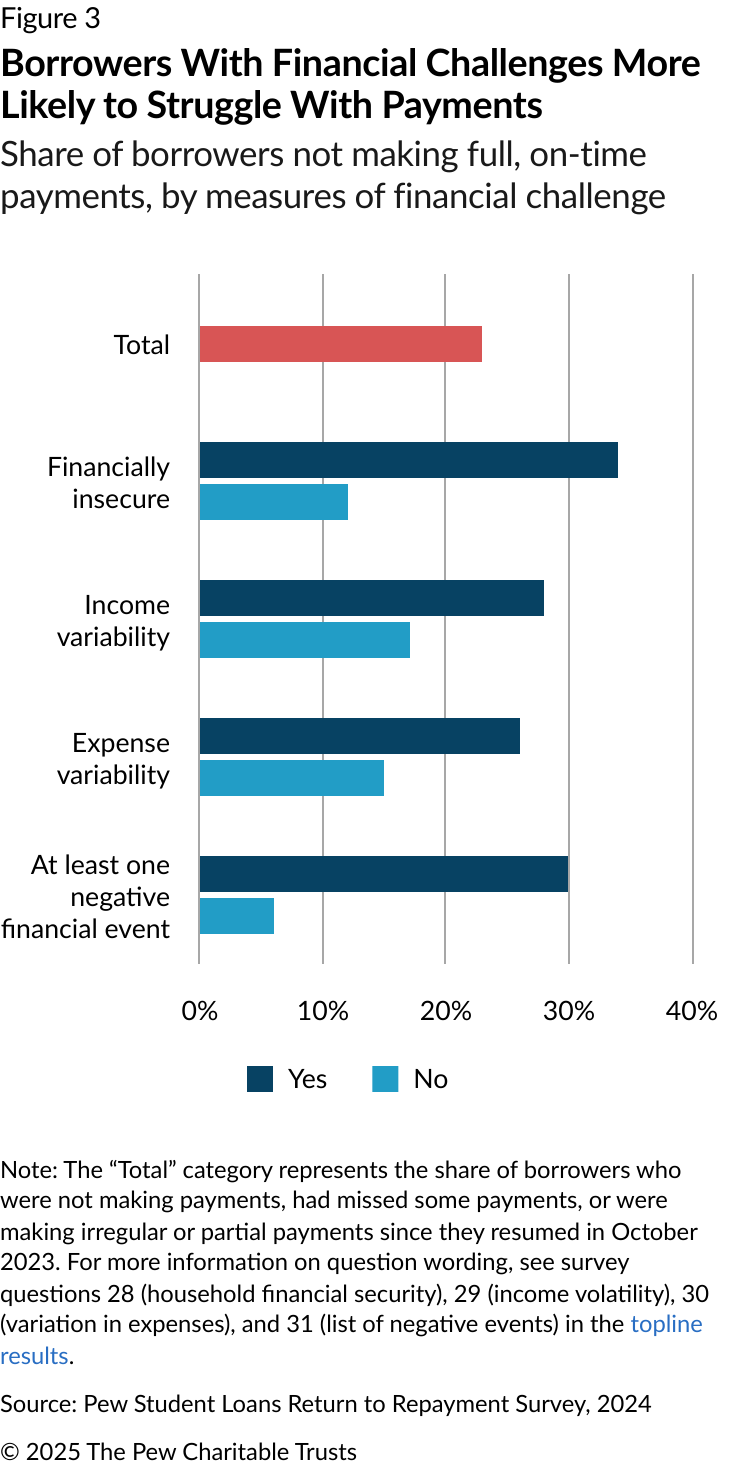

Pew’s analysis shows that borrowers who indicated signs of financial distress were more likely to experience repayment challenges. Among all borrowers in the sample, 23% indicated they were either not making payments or were making partial or irregular payments. However, among those who had indicated signs of financial instability, this share was much higher. (See Figure 3.)

Borrowers who had experienced at least one negative financial event in the last 12 months were five times as likely to miss or make irregular or partial payments compared with those who had not (30% vs. 6%). (See Figure 3.) This shows that these events are an even more powerful indicator of repayment struggles than the other measures, including perceptions of financial insecurity, volatile income, and variable expenses.

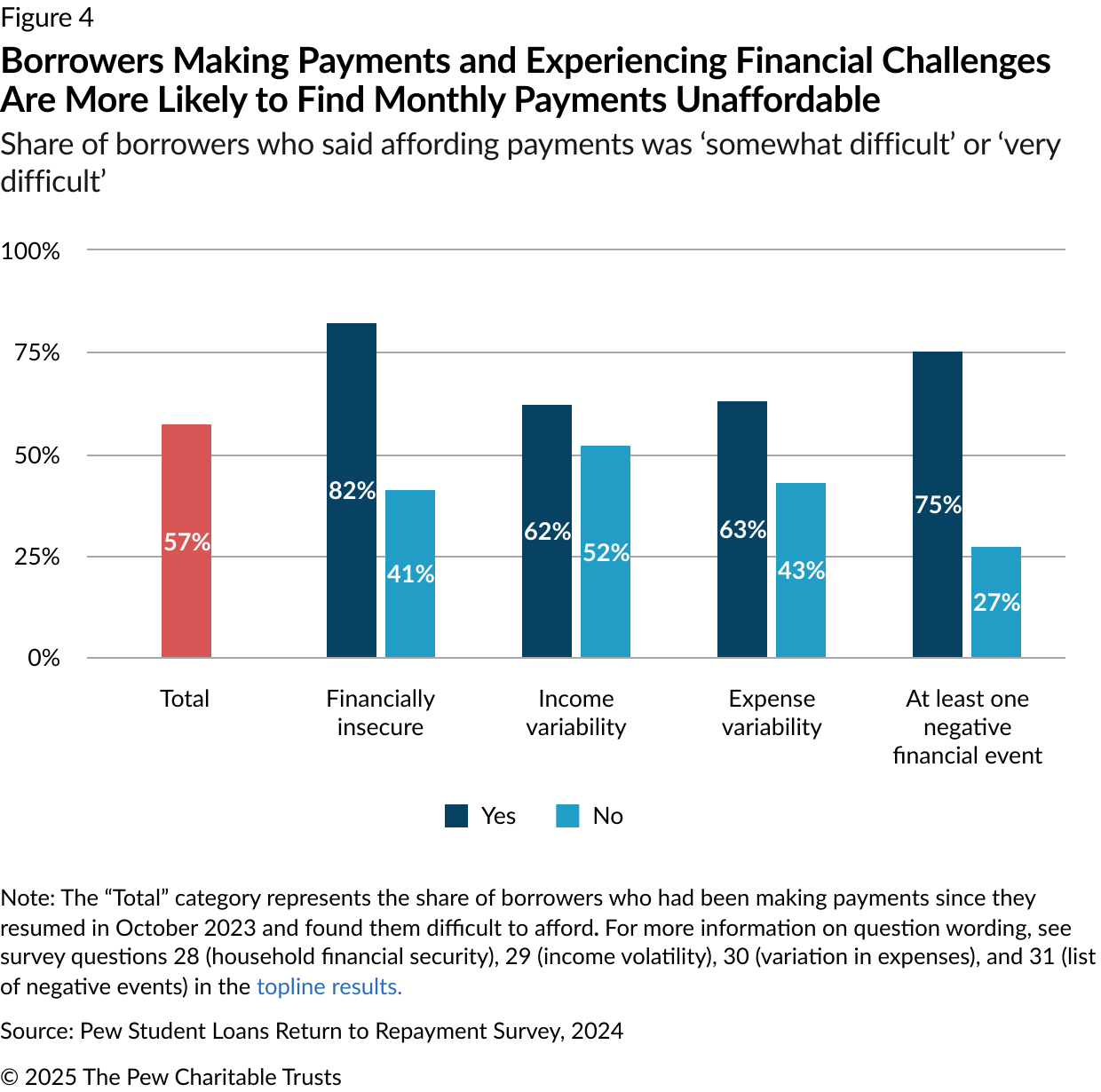

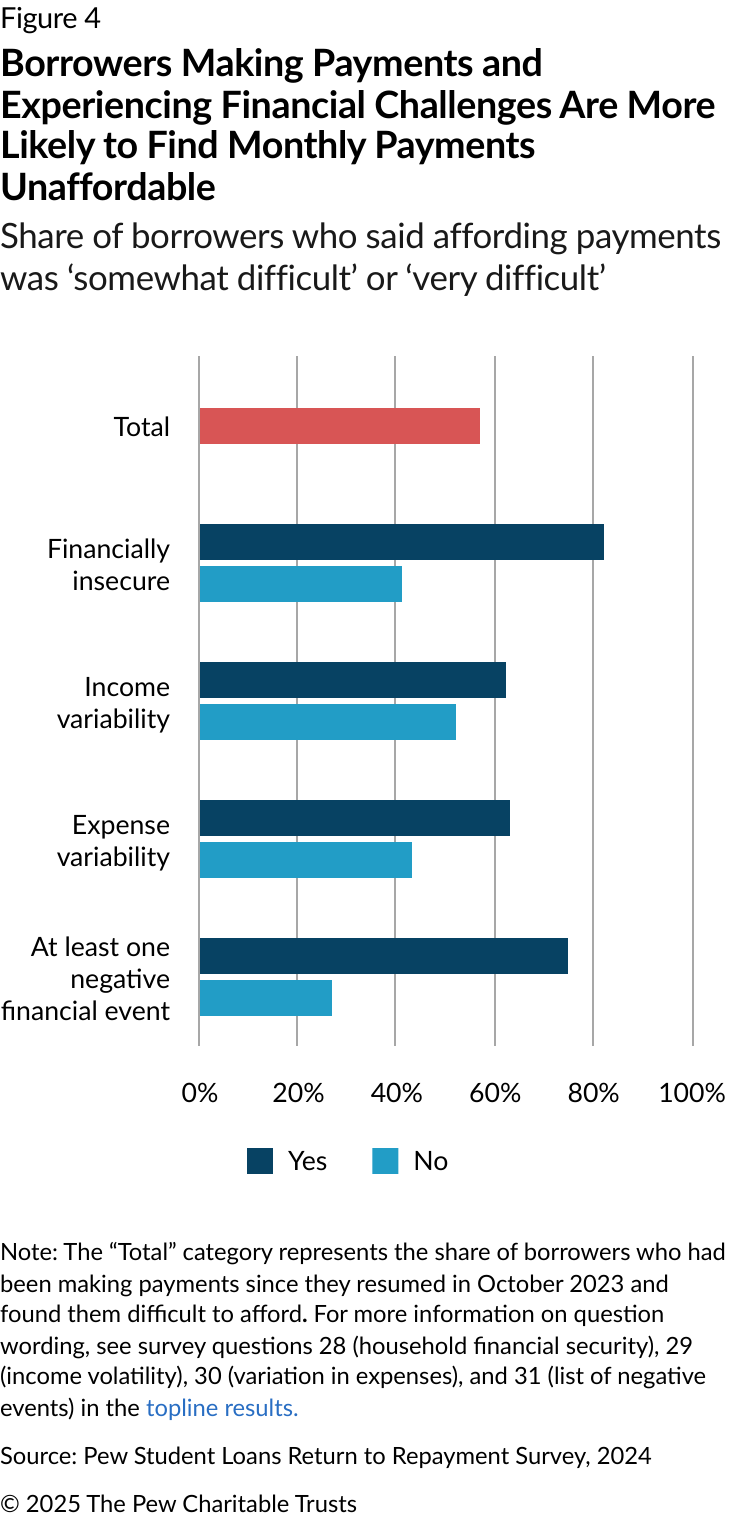

Over half (57%) of borrowers who had been making any manner of payments—whether partial, irregular, or full and on time—since October 2023 said they found them difficult to afford. The share of borrowers who indicated challenges with affordability is even higher among those who experienced financial hardship. (See Figure 4.)

Borrowers who felt financially insecure were twice as likely to find their monthly payments unaffordable as those who felt financially secure (82% vs. 41%). Similarly, borrowers who had experienced at least one negative financial event in the last 12 months were over 2.5 times as likely to find monthly payments difficult to afford as borrowers who did not experience negative financial events (75% vs. 27%).

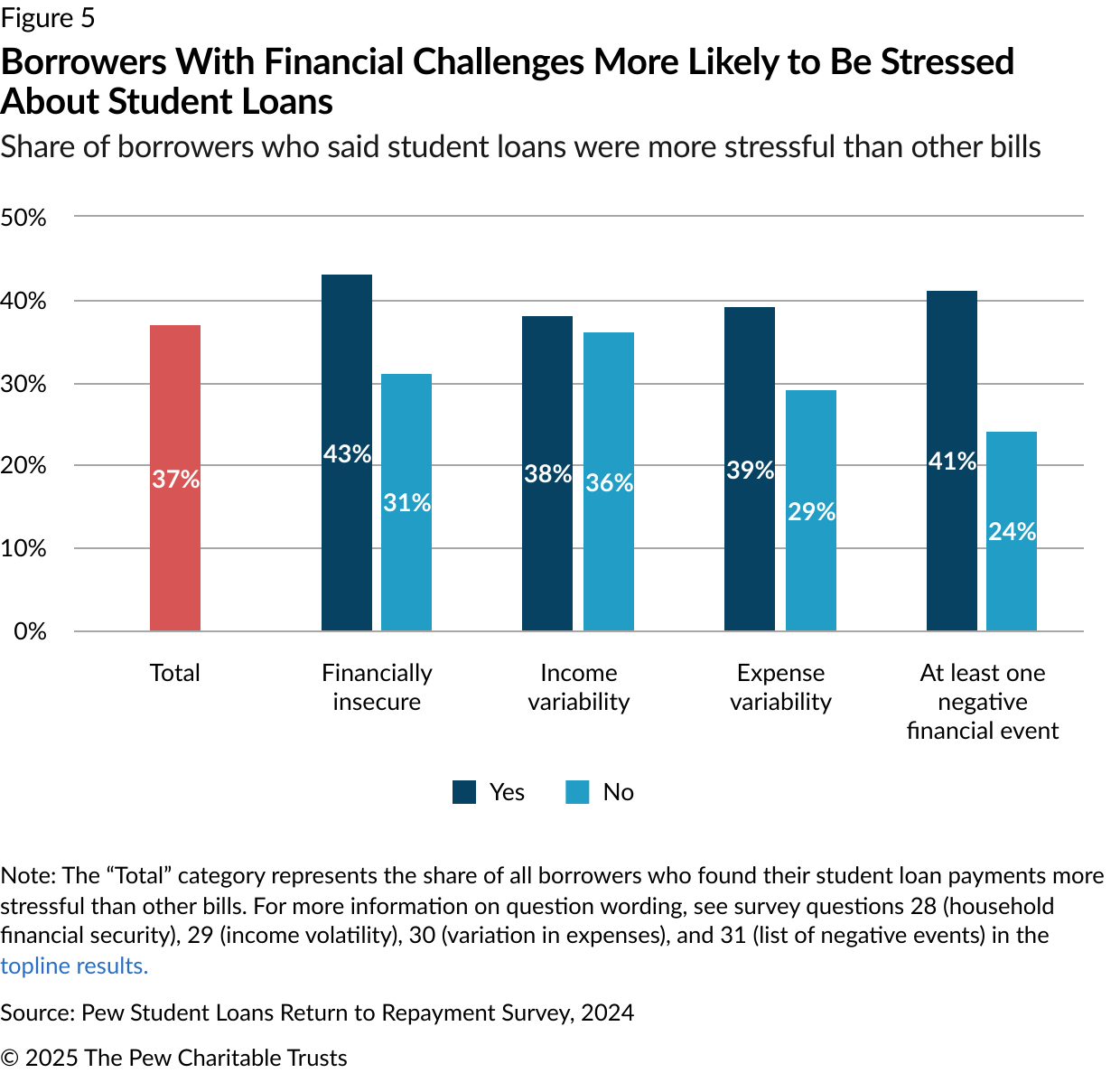

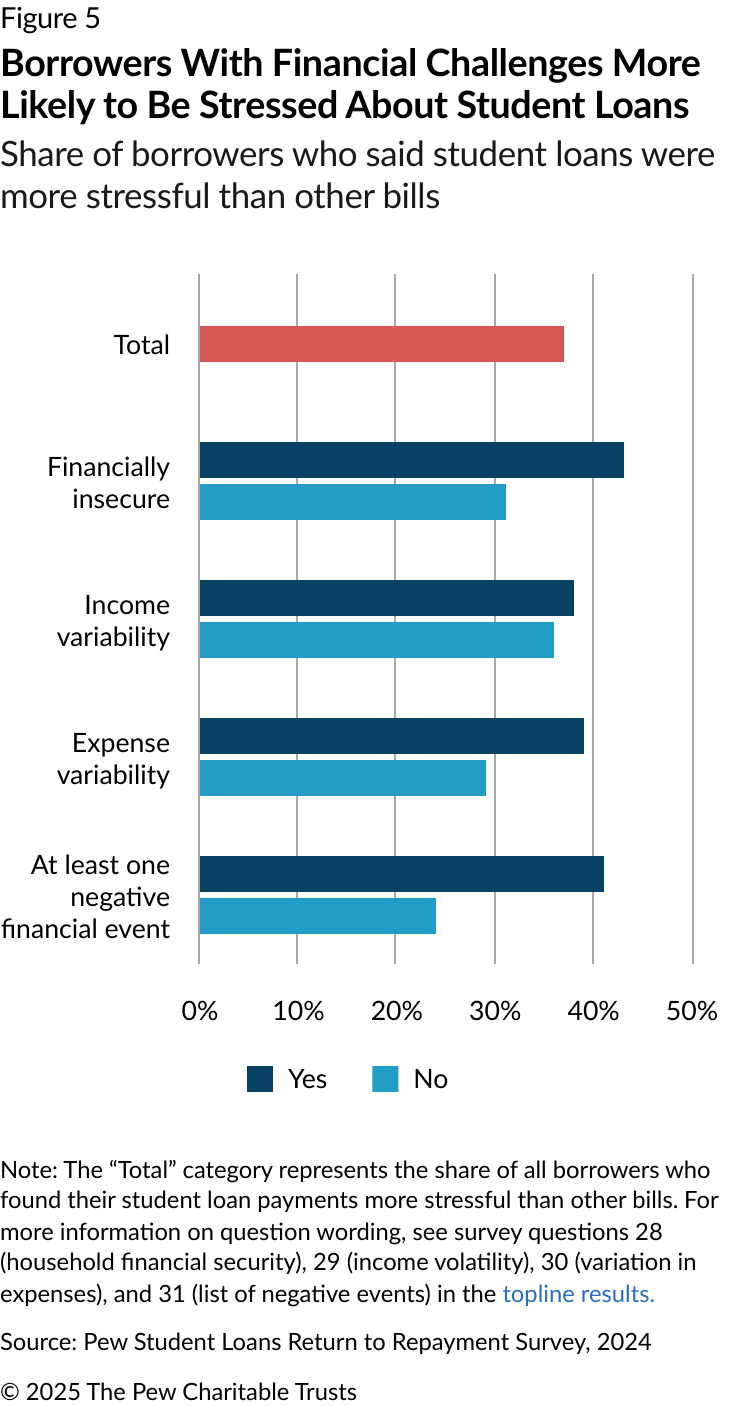

Borrowers were also asked to share how stressful they found repaying student loans compared with other bills such as rent, mortgage, car payments, and utilities. Half of the borrowers (50%) surveyed said repaying student loans was just as stressful as paying other bills, but over one-third (37%) said repaying student loans felt more stressful. (See Figure 5.) Previous Pew analyses have shown several reasons for borrowers finding repaying student loans more stressful than other bills: They do not see their balances decrease despite making on-time payments; the payments are larger than their other bills; and they expect to be paying off their student loans for a longer time.4

Among borrowers who found student loans stressful, the largest percentage point difference was between those who experienced at least one negative financial event (41%) and those who did not experience one (24%). The added stress of repaying student loans on top of experiencing a negative financial event may amplify borrowers’ difficulties during this period of uncertainty when borrowers reenter repayment. Managing these competing pressures without clear guidance from the Department of Education can hinder their successful repayment journey.

As protections expire, guidance on repayment options is crucial for struggling borrowers

For the first time since March 2020, borrowers are no longer protected from delinquency and are therefore vulnerable to default and its consequences.5 A number of repayment options can help borrowers manage payments, including different types of income-driven repayment (IDR) plans, which base payments on income and family size rather than total balance (the default rates on IDRs are half as high as on plans with fixed payments).6 However, with the significant changes on existing IDR plans, borrowers are left with fewer options that offer manageable payments.7 Borrowers need clear information on available pathways from the Department of Education to help keep their loans in good standing.

Additionally, part of the SAVE rule allowed severely delinquent borrowers to be automatically enrolled into an IDR plan if they had previously given the Internal Revenue Service consent to share their income data with the Department of Education through the implementation of the FUTURE Act.8 Such auto-enrollment policies can be helpful in preventing default, especially among the 23% of new borrowers who indicated they were either not making payments or were making partial or irregular payments and also indicated signs of financial instability. The department should offer clear descriptions of the benefits of opting in to this data-sharing agreement and provide borrowers with numerous opportunities to enroll throughout repayment. Pew’s survey data shows that new borrowers are juggling financial challenges across multiple aspects of their lives, so there should be an effort to inform them of any automatic protections that can help them manage these competing financial priorities.

Methodology

This analysis is based on data from an online survey conducted by SSRS on behalf of The Pew Charitable Trusts using its Opinion Panel as well as the Ipsos Knowledge Panel. Interviews were conducted online from May 30 to July 2, 2024, among 1,533 current nonstudent federal student loan borrowers (age 18 and older). The margin of error for total respondents is plus or minus 3.1 percentage points at the 95% confidence level. This means that in 95 out of every 100 samples drawn using the same methodology, estimated proportions based on the entire sample will be no more than 3.1 percentage points away from their true values in the population. For estimates smaller or larger than 50%, the margin of sampling error will be smaller. Margins of error will be larger for subgroups.

Acknowledgments

This brief was researched and written by Pew staff members Richa Bhattarai, Lexi West, and Janette Barbosa. It benefited from the valuable insights and expertise of external reviewers Tia Caldwell, former senior policy analyst at New America, and Madison Weiss, senior policy analyst at The Center for American Progress. Although they reviewed drafts of the brief, neither they nor their institutions necessarily endorse the brief’s findings or conclusions.

Endnotes

- Lexi West, Ilan Levine, and Ama Takyi-Laryea, “Many Student Loan Borrowers Vulnerable to Default When Payments Resume,” The Pew Charitable Trusts, 2023, https://www.pewtrusts.org/en/research-and-analysis/articles/2023/05/04/many-student-loan-borrowers-vulnerable-to-default-when-payments-resume.

- “(Gen-22-13) Federal Student Aid Eligibility for Borrowers with Defaulted Loans (Updated January 6, 2025),” Office of Federal Student Aid, Aug. 17, 2022, https://fsapartners.ed.gov/knowledge-center/library/dear-colleague-letters/2022-08-17/federal-student-aid-eligibility-borrowers-defaulted-loans.

- Juliana Kim, “Two Major Student Loan Grace Periods Are Set to Expire This Week. Here's What to Know,” NPR, September 30, 2024, https://www.npr.org/2024/09/30/nx-s1-5133296/student-loan-default-fresh-start-explainer/.

- Lexi West, Shelbe Klebs, and Richa Bhattarai, “Student Loan Borrowers Concerned About Affording Payments After Pandemic Pause,” The Pew Charitable Trusts, 2023, https://www.pewtrusts.org/en/research-and-analysis/articles/2023/12/12/student-loan-borrowers-concerned-about-affording-payments-after-pandemic-pause.

- Ilan Levine, Ama Takyi-Laryea, and Phillip Oliff, “At What Cost? The Impact of Student Loan Default on Borrowers,” The Pew Charitable Trusts, 2023, https://www.pewtrusts.org/en/research-and-analysis/issue-briefs/2023/02/at-what-cost-the-impact-of-student-loan-default-on-borrowers.

- Congressional Budget Office, “Income-Driven Repayment Plans for Student Loans: Budgetary Costs and Policy Options,” 2020, https://www.cbo.gov/system/files/2020-02/55968-CBO-IDRP.pdf.

- Department of Education Updates on Saving on a Valuable Education (SAVE Plan),” U.S. Department of Education, Jan. 15, 2025, https://www.ed.gov/higher-education/manage-your-loans/save-plan.

- Michele Streeter, Rachel Gentry, and Raymond AlQaisi, “How the FUTURE Act Improves the Federal Financial Aid System,” the Institute for College Access & Success, Dec. 19, 2019, https://ticas.org/affordability-2/how-the-future-act-improves-the-federal-financial-aid-system/