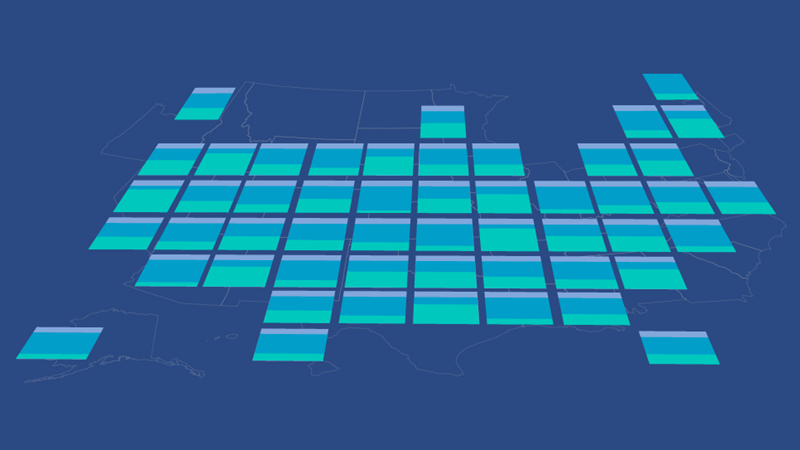

Where States Get Their Money

FY 2019

Note: this data has been updated.

Taxes and federal funds together account for 80.5% of revenue for the 50 states. Taxes are the largest revenue source in 46 states, while federal funds are greatest in four: Alaska, Louisiana, Montana, and Wyoming.

This infographic displays a breakdown of each state’s revenue by major categories.