Demand for Broadband Workforce Expected to Rise to Meet BEAD Requirements

Worker availability, wages, competition, and job classification issues present barriers to growth

Editor’s Note: This issue brief was updated on January 21, 2026, to correct style inconsistencies.

The success of federal broadband investments—especially the $42.5 billion Broadband Equity, Access, and Deployment (BEAD) program—depends on whether the U.S. has enough trained workers to build and maintain a workforce. Evidence suggests that worker shortages, misaligned training timelines, and inconsistent data could delay states from meeting BEAD’s ambitious deadlines.

On June 6, 2025, the U.S. Department of Commerce updated the BEAD implementation guidance. The new rules require states to reopen provider selection, which could delay funding in some places and accelerate it in others—making worker readiness more urgent. In addition, the suspension of nondeployment funds reduces resources that states had planned to use for workforce development.

Workforce challenges have already been widely cited as risk factors in almost every state. According to an analysis by The Pew Charitable Trusts, 41 states and Washington, D.C., identified workforce challenges in their BEAD or Digital Equity Act (DEA) plans: DEA was a separate Infrastructure Investment and Jobs Act (IIJA) program that provided support for digital adoption and workforce training, but was canceled in May 2025.1 Those challenges included barriers for workers trying to join the industry and a lack of detailed federal job classification data—suggesting that workforce shortages are not only local but a potential nationwide barrier to BEAD implementation.

In assessments of workforce needs specific to BEAD, the National Telecommunications and Information Administration (NTIA) said the following workers are needed to expand broadband infrastructure:

- Equipment operators.

- Fiber and wireless technicians.

- Inspectors.

- Laborers and manual movers.

- Master and stage electricians.

- Network architects and coordinators.

- Radio frequency and field engineers.

- Software engineers.

- Structural engineers.

- Surveyors and drafters.

- Trenchers.

- Trucking crews.2

As internet service providers (ISPs) and their contractors compete with other industries for a shrinking number of skilled employees—specialized technicians and construction workers alike—accurate assessments of workforce shortages are critical to reach BEAD’s promise to bring all U.S. households affordable and high-speed internet connections quickly.

This issue brief describes the anticipated increased demand for the broadband workforce—and examines the primary barriers to the growth of that workforce.

Key findings include:

- The pool of skilled telecommunications workers is shrinking just as demand is rising sharply. Policymakers should examine the barriers to growth for specific broadband-related occupations to meet both short- and long-term needs.

- Training requirements mean new workers cannot be mobilized quickly, raising risks of deployment delays.

- Competitive wages and benefit packages are crucial as telecommunications employers compete for workers across industries or those who are supporting other infrastructure projects funded through the IIJA.

- Inconsistency in jobs classifications in federal data obscure workforce needs. Greater collaboration between employers and federal and state governments is needed to standardize data and improve planning.

Demand for the broadband workforce

The BEAD program—along with the DEA—was built upon earlier federal and state broadband programs; its $42.5 billion grant program to states is intended to reach all broadband serviceable locations (BSLs).3 The Federal Communications Commission (FCC) defines a BSL as any business or residential location in the U.S. at which mass-market internet access service is, or can be, installed.4 Other federal programs—such as the Capital Projects Fund (CPF) and Rural Digital Opportunity Fund (RDOF)—are ongoing and may overlap with BEAD-funded projects, further increasing worker demand.5 In addition to this federal and state funding, ISPs commit substantial resources to the industry—totaling $94.7 billion in investments, including capital expenditures, in 2023 alone—that also increase the demand for workers.6 NTIA expects that by next year, most states will have shortages of the types of workers needed to implement BEAD, and it estimates that the shortages will vary by state and by job type.7

NTIA noted this anticipated challenge in its original 2022 Notice of Funding Opportunity and required state broadband offices to identify broadband workforce shortages and to create plans to address them in their five-year action plans—comprehensive documents outlining each state’s broadband access, affordability, equity, and adoption needs and strategies for meeting them.8 Though BEAD and its funded projects will likely result in greater demand for workers than earlier programs did, workers could move between projects funded by different federal broadband programs, as award availability and project build deadlines will vary by program. This presents an additional challenge in projecting workforce needs to support BEAD, given that projects funded by programs such as the CPF and RDOF are ongoing and may overlap with BEAD projects.9

One of the most authoritative sources on estimated demand—a 2022 Government Accountability Office (GAO) report—found that there were 477,700 workers in the fixed broadband workforce and 88,600 in the mobile broadband workforce.10 The report analyzed Bureau of Labor Statistics (BLS) data on 10 broadband occupations identified through interviews with industry employers and associations and estimated that in 2023, at the peak of broadband’s federal funding, 23,000 workers that year would be funded by federal investments into broadband infrastructure, dropping to an estimated 9,000 workers supported by 2031—because of inflation and each federal program having a different sunset date. For example, CPF funds must be expended by the end of 2026, BEAD-funded projects must be completed within four years of receiving a grant, and RDOF recipients must provide service to project locations within eight years of receiving funding.11 These estimates don’t include the workforce required to maintain these new networks after deployment.

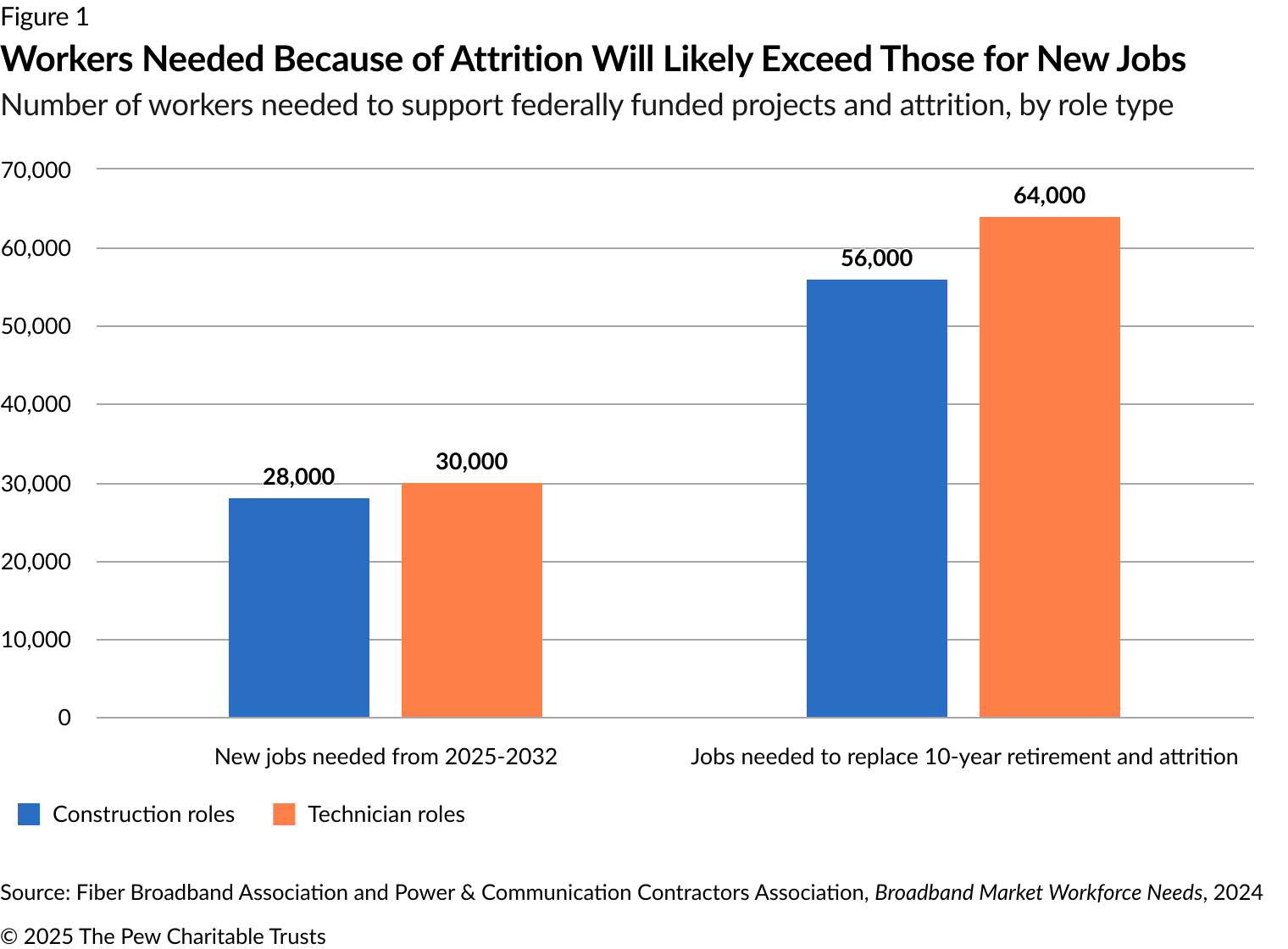

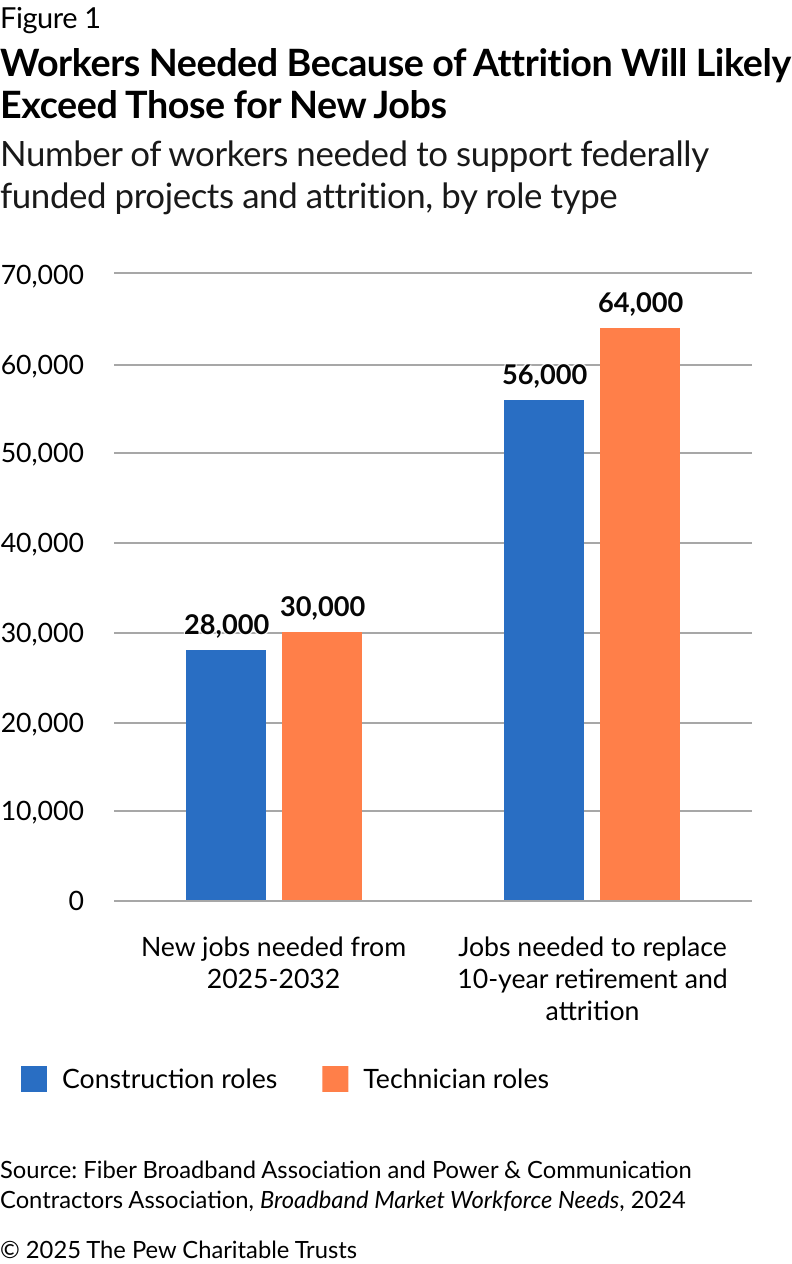

An industry market study conducted by Continuum Capital, a private firm, on behalf of the Fiber Broadband Association (FBA) and the Power & Communication Contractors Association (PCCA), found that the need for new workers to join the broadband industry will be significant between 2025 and 2032—the primary window for projects funded by BEAD and other federal programs.12 The study also found that the number of workers who are retiring and leaving the field over the next 10 years will be even greater than the number of new workers needed by 2032. An estimated 28,000 new broadband construction-related jobs and 30,000 new technician jobs will need to be filled, with an additional 56,000 and 64,000 workers in those categories, respectively, needed to replace departing workers over the next 10 years.13 This may indicate that while thousands of workers will be needed to ensure the implementation of BEAD and other federal investments in broadband deployment, long-term strategies to attract and retain workers will be needed to ensure that the networks providing universal access are maintained and expanded beyond the next decade.

A confluence of factors, including insufficient federal data, ISP hiring trends, and a reliance on subcontractors, creates uncertainty about the health and size of the available workforce. It is also important to consider that changes in telecommunications employment practices may mean that fewer workers are identified as “broadband” workers in federal datasets, even if they continue to work in the industry. Over time, large telecommunications employers have increasingly favored contracting out work, rather than maintaining all workers as full-time employees, as was common practice decades ago.14 This trend is evident in the smaller share of telecommunications workers being represented by a union over time. In 2000—the earliest year for which data is available—26% of workers were represented by a union, falling to 11% in 2024.15 This may indicate that the industry continues to shift away from employing full-time, directly hired broadband workers to rely more heavily on a contractor workforce.

Those contractors often further subcontract for specific projects. Those smaller firms may not be classified as “telecommunications” firms for federal data collection purposes as many of them staff projects across a range of industries—using construction workers, heavy equipment operators, and trenchers who work on energy, water, and other infrastructure projects. The lack of telecommunications classification could underrepresent the size of the current workforce and overestimate the number of positions that need to be filled to complete federally funded projects.16 Also, large telecommunications companies continue to lay off employees, as they have for several years.17 This underscores the need for more data on both broadband-specific roles and contractor employment trends to obtain a clearer view of the broadband workforce and to identify potential shortages.

Barriers to growth in the broadband workforce

BEAD’s increased demand for infrastructure construction, installation, improvement, and maintenance projects will strain a telecommunications workforce that has already been shrinking since its peak in the early 2000s.

The telecommunications industry grew rapidly in the late 1990s through 2000, partly because of deregulation of the market introduced in the Telecommunications Act of 1996, advancements in fiber-optic technology, and increased internet use.18 These conditions combined to increase demand for telecommunications services—and therefore telecommunications workers—until a significant decline in the industry caused by overinvestment began in 2000.19

Job classification and data limitations

Outdated and inconsistent job classifications across federal and state systems make it difficult to assess broadband workforce needs.

The North American Industry Classification System (NAICS)—developed by the U.S. Census Bureau—contains business and economic data on an industrywide basis but lacks detail on individual employment metrics.20 Additionally, individual businesses may operate across industries in a way that does not align with NAICS’ complex coding system, which could lead to imprecise estimates. For example, while some construction companies work on telecommunications infrastructure projects, they may not identify themselves as a telecommunications company and would therefore not be captured in estimates for that industry. While the BLS’ Standard Occupational Classifications (SOC) system includes data on some broadband occupations, including “telecommunications line installers and repairers,” “radio, cellular, and tower equipment installers and repairers,” and “telecommunications equipment installers and repairers,” the coding system does not have a “broadband” job group, and these jobs also exist in industries beyond broadband.21 The U.S. Department of Labor maintains O*Net—a dataset containing occupation descriptions based on the SOC classification system—which also lacks job codes specific to broadband.22 Furthermore, states describe and report broadband occupation data differently, meaning that state and federal data cannot be combined usefully across definitions or metrics.

These inconsistent job classifications and inadequate data make it difficult for states to quantify specific job shortages and for education providers to design training and credential programs that could help meet workforce demand. Industry leaders, government-led working groups, and government research indicate that consistent, industrywide training and pathways are difficult to establish. According to the 2020 working group report, “There is no uniform credentialing for specific job titles within the industry. For example, current broadband technicians typically have individualized skill sets, and employers or educators have a hard time grouping them together for purposes of recruiting and training.”23 While a variety of credentials exist, they “generally are narrowly defined, have limited capacity, and therefore do not identify a broad pathway for future graduates or produce enough graduates.” Broadband industry credentials are offered by community colleges, career and technical education providers, employers, and trade associations. Some programs offer job-specific training—such as fiber-optic technician certifications—while others offer industrywide skills, such as Occupational Safety and Health Administration certifications.

As states and industry plan for their BEAD deployments, accurate data on roles, required skills and competencies, and trends in employment metrics—such as employer type and wages—will be necessary to ensure that BEAD dollars are spent effectively to close the workforce gaps that pose the greatest risk to deployment projects.

Worker availability

The workforce is aging: Nearly one-fifth (17%) of telecommunications workers are now between 55 and 64, compared with 7% in the 1970s. Similarly, the share of workers 65 or older make up 3% of the workforce, up from 1% from the 1970s to 2000s.24

With the number of retirements rising above predicted levels during the COVID-19 pandemic and remaining high, the broadband workforce faces a significant skills gap—without an immediate way to replace those skills.25 As the GAO reported, even when finding new applicants is possible, training for broadband occupations often takes several months or more, depending on the job.26 Similarly, a recent U.S. Department of Commerce Office of the Inspector General report shared concerns from broadband officials that the time frame of BEAD funding left states with only three years “to add thousands of jobs, which is difficult when training programs last for 12 to 24 months.”27 Considering the FBA and PCCA estimates for the number of new hires needed to replace retiring workers, states will need to focus on backfilling roles quickly to attain a BEAD-ready workforce.

Industry leaders say they are concerned that potential workers may be unaware of the opportunity presented by broadband jobs, which are generally well paying and full time and equip workers with transferable skills. The FBA’s Workforce Development Guidebook notes that “not enough people know about entry-level telecommunications jobs and the associated high starting wages, earning potential, prospect of upward advancement, and/or career opportunities” and that this lack of awareness is a primary driver of the skilled labor shortage.28 A report from the FCC’s 2020 Broadband Infrastructure Deployment Job Skills and Training Opportunities Working Group (FCC working group)—a stakeholder group tasked with addressing job training for the broadband workforce— characterizes this lack of awareness as a “broadband brand identity crisis”: Prospective employees cannot identify a training pathway into an unfamiliar industry.29

Even when workers are aware of the benefits of broadband infrastructure jobs, deployment projects aimed at bringing broadband to underserved and unserved areas may have trouble recruiting workers if they are unable to travel great distances to join projects. As one association estimated in the GAO analysis, only “between 10 and 15 percent of telecommunications workers ever travel beyond 200 miles from their homes for work.”30 As noted in a 2022 Congressional Research Service article, Tribal and rural areas are less likely to have broadband than urban and suburban areas—“and could have a potentially smaller trained broadband workforce” available to help extend broadband to their underserved areas.31 Training programs also tend to focus on local and regional job needs, which means that employers without a nearby training program or partnership face additional recruiting challenges.32

With states set to receive final approval of their BEAD plans in the coming months, more projects may launch in locations reachable by new prospective workers—especially as BEAD dollars will primarily flow to rural areas. The lack of a specialized workforce in these areas will necessitate urgent action to attract new workers and remove barriers for workers already in the area to transition into broadband jobs.

Wages and Competition

Although shortages are expected, wages for broadband jobs have remained flat. Normally, rising demand drives wages higher, but the sector has not adjusted compensation to attract new workers—suggesting that shortages may persist unless employers raise pay, especially as BEAD competes with other infrastructure projects for the same workers.33

Growth in broadband industry wages over many decades has been primarily for higher paying jobs or for employees with longer tenures. A 2020 Economic Policy Institute analysis of BLS’ Current Population Survey wage data shows dramatically different wage patterns for telecommunications workers whose earnings are in the 10th percentile (low), 50th percentile (median), and 90th percentile (high). Well-paid workers made significantly higher wages in 2016-19 than in the 1970s (adjusted for inflation), and their wages have grown more over time than the wages of non-telecommunications workers in the same percentile.34 Meanwhile, median wages have increased more slowly than in the 1970s. Still, the wage increases have outpaced those of non-telecommunications workers. Wages for low-earning telecommunications workers have fallen over the years (adjusted for inflation), while wages for all non-telecommunications workers in the same percentile grew slightly.

The GAO analysis of BLS data from 2010 to 2021 similarly found that for five occupations related to broadband deployment, wage growth was not significantly higher than in the overall economy.35 However, a 2023 report by the Telecommunications Interagency Working Group—which includes representatives from the FCC, the NTIA, and the departments of Labor and Education—found that hiring remained difficult even when employers offered higher pay, which paints a murky picture of wages’ influence on attracting prospective workers.36

As ISPs compete with other industries and infrastructure projects for employees, competitive wages for entry-level applicants will be even more important.37 In addition to investments in broadband deployment, the IIJA included funds for a variety of projects, including expansion and improvements of transportation, climate resilience, and clean water infrastructure, many of which may draw construction workers, technicians, and support workers before BEAD-funded builds have even begun.38 The FCC working group report cited the “cost of training, both in-house and outside” for employers, which bear “the risk of losing newly trained employees to competing companies or industries.”39 It added that competition presents “one of the foremost issues” for employers it interviewed. The working group also found that some employers mitigate this risk by tying tuition reimbursement to an agreement to remain with an employer for a specified length of time, which some prospective hires may wish to avoid.

As demand increases for broadband-specific roles, states and industry will need to try to ensure competitive wages for employees who are either new to or returning to the field—both to bolster the workforce needed to deploy BEAD and other federally funded projects and to protect the long-term viability of the broadband industry as it competes with other fields for technicians and construction workers.

Conclusion

BEAD presents an unprecedented opportunity to extend broadband infrastructure to all unserved and underserved locations in the U.S., though timeliness is essential for BEAD’s success. The shrinking telecommunications workforce, just as demand for those workers is likely to increase sharply, requires a close examination of barriers to growth in broadband job fields. The demographic and geographic barriers to expanding the workforce are exacerbated by job classification and data and reporting issues, which will require greater collaboration between federal, state, and industry stakeholders to formalize how employment trends and needs are measured. More cohesive data could lead to training programs that more directly address both the short- and long-term skills shortages in the broadband workforce.

Attracting and retaining workers in this industry will depend on competitive wages, as telecommunications employers compete for workers whose skills are relevant to technician and construction jobs, which are also in demand because of other federal investments in infrastructure.

As states work to comply with the updated—and for many states, condensed—BEAD process, they may find themselves facing workforce shortages sooner than expected, and with fewer resources available to address them. More research will be needed to identify strategies that the federal government, states, and providers can use to expand their broadband workforce quickly.

Endnotes

- “State Digital Equity Spending Can Benefit Economies, Health Care, and Education,” Kelly Wert, Oct. 17, 2024, https://www.pew.org/en/research-and-analysis/articles/2024/10/17/state-digital-equity-spending-can-benefit-economies-health-care-and-education. “NTIA Terminates Digital Equity Act Grants,” Seamus Dowdall, National Association of Counties, May 14, 2025, https://www.naco.org/news/ntia-terminates-digital-equity-act-grants#:~:text=Key%20Takeaways,Grant%20Program%20($1.25%20billion).

- National Telecommunications and Information Administration, “State Workforce Research Findings: New Mexico,” https://connect.nm.gov/uploads/1/4/1/9/141989814/ntia_state_workforce_research_findings_new_mexico.pdf.

- “Together, Broadband Deployment and Digital Inclusion Programs Support Increased Internet Adoption,” Kelly Wert, The Pew Charitable Trusts, Jan. 28, 2025, https://www.pew.org/en/research-and-analysis/articles/2025/01/28/together-broadband-deployment-and-digital-inclusion-programs-support-increased-internet-adoption.

- “About the Fabric: What a Broadband Serviceable Location (BSL) Is and Is Not,” Federal Communications Commission, June 26, 2025, https://help.bdc.fcc.gov/hc/en-us/articles/16842264428059-About-the-Fabric-What-a-Broadband-Serviceable-Location-BSL-Is-and-Is-Not.

- “Capital Projects Fund,” U.S. Department of the Treasury, https://home.treasury.gov/policy-issues/coronavirus/assistance-for-state-local-and-tribal-governments/capital-projects-fund. “Auction 904: Rural Digital Opportunity Fund,” Federal Communications Commission, https://www.fcc.gov/auction/904.

- USTelecom, “2023 USTelecom Broadband Capex Report,” 2024, https://ustelecom.org/research/2023-ustelecom-broadband-capex-report/.

- National Telecommunications and Information Administration, “State Workforce Research Findings: New Mexico.”

- Broadband Equity, Access, and Deployment Program Notice of Funding Opportunity, National Telecommunications and Information Administration, 2022, https://broadbandusa.ntia.gov/sites/default/files/2022-05/BEAD%20NOFO.pdf. “Workforce Development Memo,” Jake Varn, The Pew Charitable Trusts, July 21, 2023, https://www.pew.org/-/media/assets/2023/12/bai-workforce-development-memo---update-2023_webready.pdf.

- “Capital Projects Fund,” U.S. Department of the Treasury, https://home.treasury.gov/policy-issues/coronavirus/assistance-for-state-local-and-tribal-governments/capital-projects-fund. “Auction 904: Rural Digital Opportunity Fund.”

- Government Accountability Office, “Telecommunications Workforce: Additional Workers Will Be Needed to Deploy Broadband, but Concerns Exist About Availability,” 2022, https://www.gao.gov/assets/gao-23-105626.pdf.

- Guidance for the Coronavirus Capital Projects Fund: For States, Territories & Freely Associated States, U.S. Department of the Treasury, 2021, https://home.treasury.gov/system/files/136/Capital-Projects-Fund-Guidance-States-Territories-and-Freely-Associated-States.pdf. Broadband Equity, Access, and Deployment Program Notice of Funding Opportunity, National Telecommunications and Information Administration. “Auction 904: Rural Digital Opportunity Fund Fact Sheet,” Federal Communications Commission, https://www.fcc.gov/auction/904#time.

- Fiber Broadband Association and Power & Communication Contractors Association, “Broadband Market Workforce Needs,” 2024, https://fiberbroadband.org/wp-content/uploads/2024/08/PCCA_FBA_6-26-2024_vFinal_1.pdf.”

- Fiber Broadband Association and Power & Communication Contractors Association, “Broadband Market Workforce Needs.””

- John Schmitt and Jori Kandra, “Decades of Slow Wage Growth for Telecommunications Workers,” Economic Policy Institute, 2020, https://www.epi.org/publication/decades-of-slow-wage-growth-for-telecommunication-workers/.

- “Union Affiliation Data From the Current Population Survey,” U.S. Bureau of Labor Statistics, https://data.bls.gov/timeseries/LUU0204919000?amp%253bdata_tool=XGtable&output_view=data&include_graphs=true.

- John Schmitt and Jori Kandra, “Decades of Slow Wage Growth for Telecommunications Workers.”

- “Fierce Network’s 2025 Telecom and Tech Layoff Tracker—Microsoft Axes 6,000,” Diana Goovaerts, Fierce Network, May 20, 2025, https://www.fierce-network.com/broadband/fierce-networks-2025-telecom-and-tech-layoff-tracker.

- Elise A. Couper, John P. Hejkal, and Alexander Wolman, “Boom and Bust in Telecommunications,” Federal Reserve Bank of Richmond Economic Quarterly (2003): https://www.richmondfed.org/~/media/richmondfedorg/publications/research/economic_quarterly/2003/fall/pdf/wolman.pdf.

- Elise A. Couper, John P. Hejkal, and Alexander Wolman, “Boom and Bust in Telecommunications.”

- “North American Industry Classification System,” United States Census Bureau, July 3, 2025, https://www.census.gov/naics/#q1.

- “2018 Standard Occupational Classification System,” U.S. Bureau of Labor Statistics, https://www.bls.gov/soc/2018/major_groups.htm.

- “O*Net,” U.S. Department of Labor, https://www.dol.gov/agencies/eta/onet.

- Broadband Infrastructure Deployment Job Skills and Training Opportunities Working Group, “Broadband Infrastructure Deployment Job Skills and Training Opportunities Working Group Report,” 2020, https://www.fcc.gov/sites/default/files/bdac-job-skills-training-opportunities-approved-rec-10292020.pdf.

- John Schmitt and Jori Kandra, “Decades of Slow Wage Growth for Telecommunications Workers.”

- “Excess Retirements Continue Despite Ebbing COVID-19 Pandemic,” Miguel Faria-e-Castro and Samuel Jordan-Wood, Federal Reserve Bank of St. Louis, June 22, 2023, https://www.stlouisfed.org/on-the-economy/2023/jun/excess-retirements-covid19-pandemic.

- Government Accountability Office, “Telecommunications Workforce: Additional Workers Will Be Needed to Deploy Broadband.”

- U.S. Department of Commerce Office of Inspector General, “Broadband Stakeholders Identified Various Challenges Affecting Broadband Deployment,” 2025, https://www.oig.doc.gov/wp-content/OIGPublications/OIG-25-014-I-SECURED-Final-Report.pdf.

- Fiber Broadband Association and Cartesian, “Broadband Workforce Development Guidebook,” 2023, https://fiberbroadband.org/wp-content/uploads/2023/05/Broadband-Workforce-Development-Guidebook-FBA-and-Cartesian-April-2023.pdf.

- Broadband Infrastructure Deployment Job Skills and Training Opportunities Working Group, “Broadband Infrastructure Deployment Job Skills and Training Opportunities Working Group Report.”

- Government Accountability Office, “Telecommunications Workforce: Additional Workers Will Be Needed to Deploy Broadband.”

- “Bridging the Digital Divide: Broadband Workforce Considerations for the 118th Congress,” Colby Leigh Pechtol, Congressional Research Service, Dec. 30, 2022, https://www.congress.gov/crs-product/IF12111.

- Broadband Infrastructure Deployment Job Skills and Training Opportunities Working Group, “Broadband Infrastructure Deployment Job Skills and Training Opportunities Working Group Report.”

- Government Accountability Office, “Telecommunications Workforce: Additional Workers Will Be Needed to Deploy Broadband.”

- John Schmitt and Jori Kandra, “Decades of Slow Wage Growth for Telecommunications Workers.”

- Government Accountability Office, “Telecommunications Workforce: Additional Workers Will Be Needed to Deploy Broadband.”

- Telecommunications Interagency Working Group, “Recommendations to Address Workforce Needs,” 2023, https://docs.fcc.gov/public/attachments/DOC-390665A1.pdf.

- Government Accountability Office, “Telecommunications Workforce: Additional Workers Will Be Needed to Deploy Broadband.”

- National Skills Coalition and Bluegreen Alliance, “Executive Summary of PERI Report: Employment Impacts of New U.S. Clean Energy, Manufacturing, and Infrastructure Laws,” 2023, https://nationalskillscoalition.org/wp-content/uploads/2023/09/0923-Executive-Summary-PERI-Report.pdf. National Skills Coalition and Bluegreen Alliance, “Executive Summary of PERI Report: Emplyoment Impacts of New U.S. Clean Energy, Manufacturing, and Infrastructure Laws.”

- Broadband Infrastructure Deployment Job Skills and Training Opportunities Working Group, “Broadband Infrastructure Deployment Job Skills and Training Opportunities Working Group Report.”