When Mortgages Are Unavailable, Potential Homebuyers Turn to Lease-Purchase Agreements

With few applicable state laws, lease-purchases often pose significant risks and high costs

Overview

Homeownership is the most common way that Americans build wealth, and mortgages are the safest and most cost-effective way of financing a home purchase. But high mortgage rates and stringent credit standards lead some aspiring homebuyers to seek other financing options, which come with greater financial risks and fewer legal protections than mortgages offer.

One such option is a lease-purchase agreement, also known as “rent-to-own” or “lease with option to purchase.” This alternative financing arrangement contains two components: a residential lease and an option contract that gives the tenant the right to purchase the property during or after the rental period. In 2021, the most recent year for which data is available, these agreements were being used by an estimated 2.4 million adults nationwide.1

Lease-purchase agreements are often touted as a pathway to homeownership for renters who are not yet financially prepared to buy.2 At best, these agreements provide prospective homebuyers the opportunity to live in a preferred home or neighborhood while giving them time to improve their credit scores and save for a down payment. But at worst, these arrangements saddle lease-purchase buyers with excessive costs and responsibilities during the rental period and ultimately fail to deliver on the promise of homeownership.3 Further, a lack of recordation data and disclosures makes it difficult for homebuyers and policymakers alike to understand the risks and benefits of lease-purchase agreements.

To gain insight into the lease-purchase market, The Pew Charitable Trusts pursued several lines of inquiry. First, researchers interviewed 55 legal aid professionals in 29 states who had experience assisting homebuyers who had used alternative financing. Second, Pew fielded a nationally representative survey of alternative financing borrowers, of which 193 respondents were using or had used lease-purchase agreements. (See Appendix.) Finally, Pew commissioned the National Consumer Law Center (NCLC) to review state laws governing lease-purchase agreements to better understand the prevailing legal landscape.

The key findings from this research:

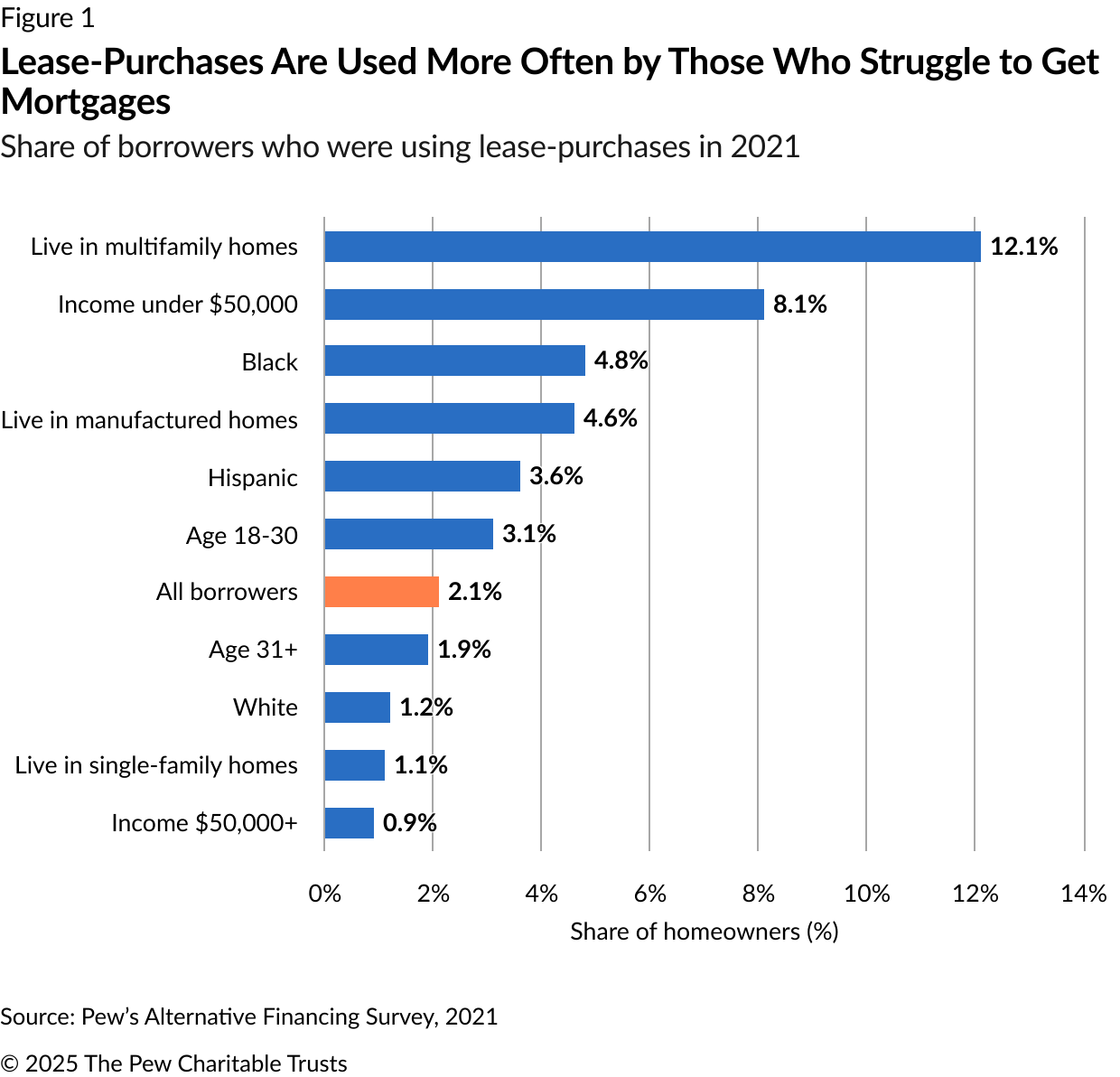

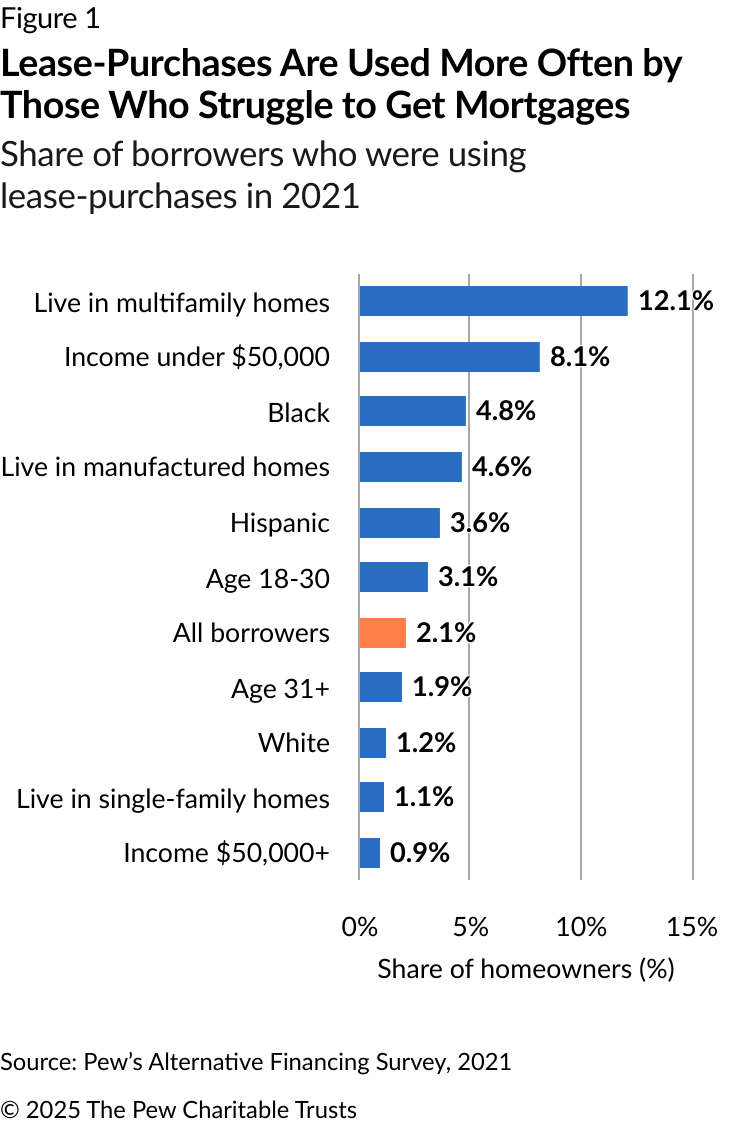

- An estimated 2.1% of homebuyers were using lease-purchase agreements in 2021. These arrangements were more common among groups that have historically struggled to get mortgages, such as low-income, Black, and Hispanic households. People seeking to purchase manufactured homes or units in multifamily buildings also relied more frequently on lease-purchase agreements than did buyers of traditional single-family homes.

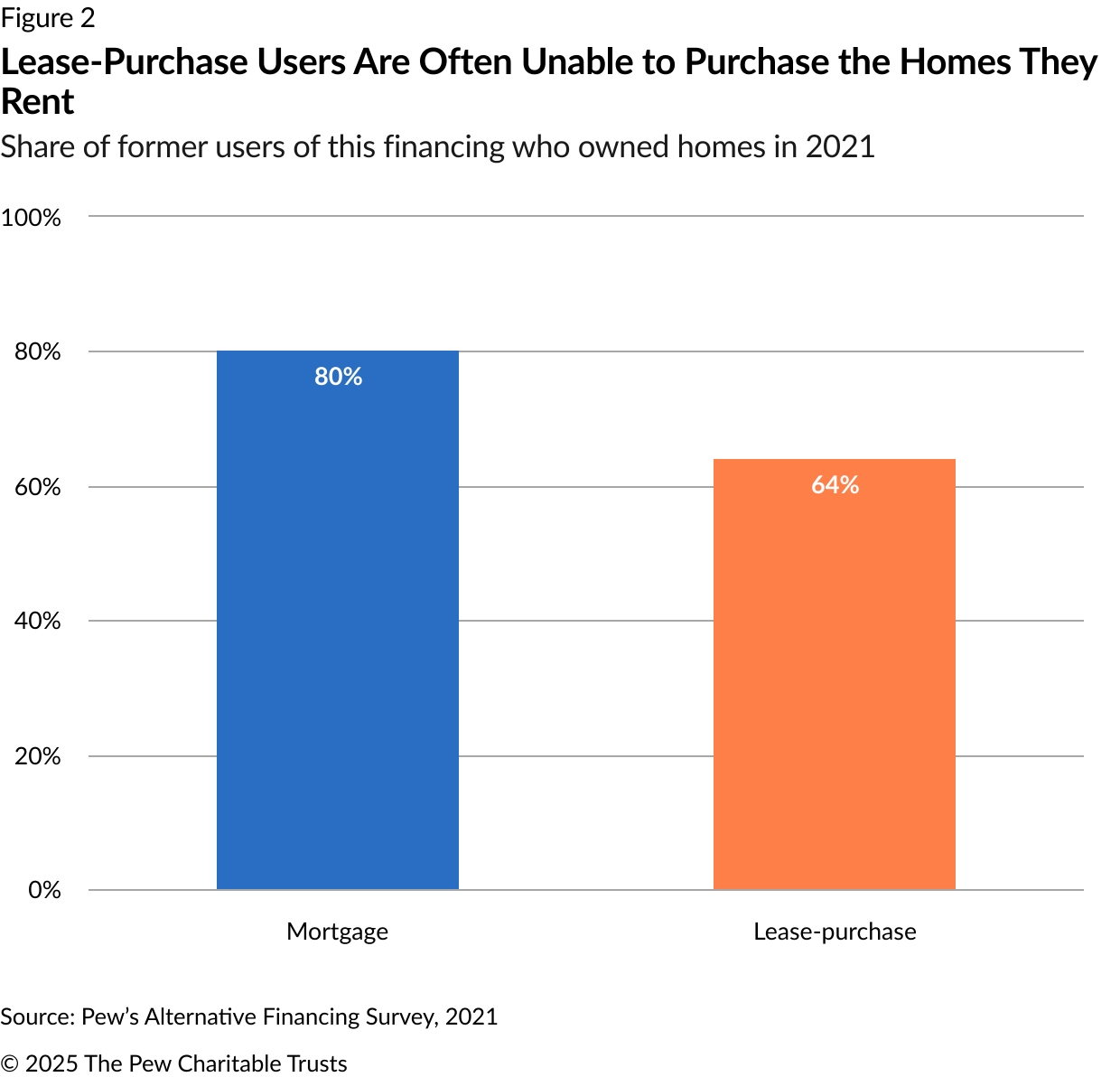

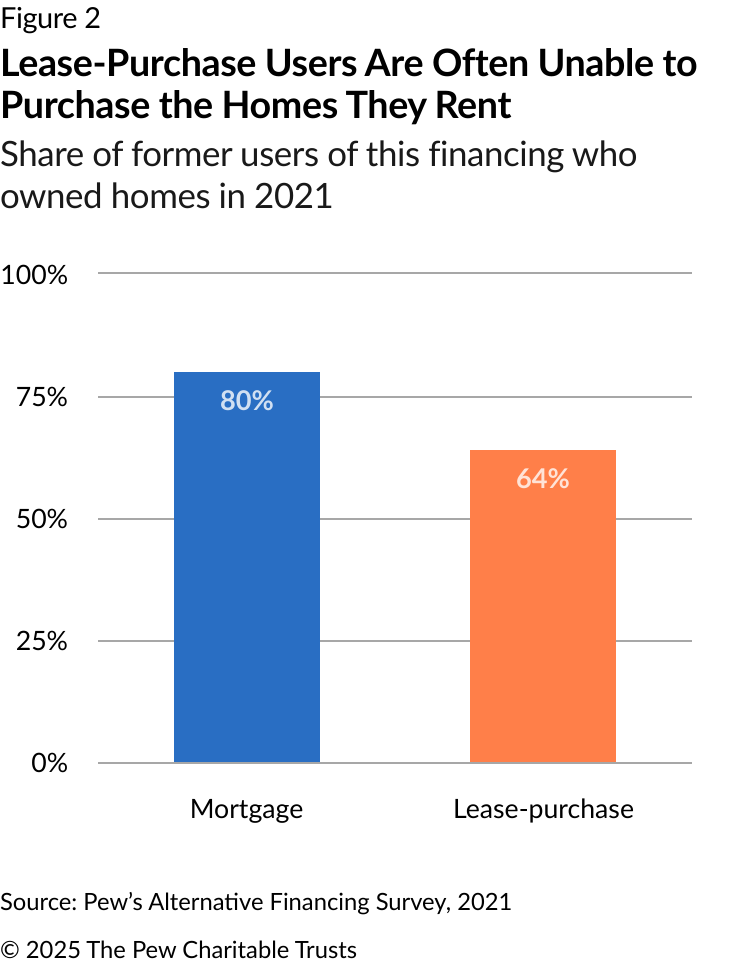

- Lease-purchase buyers were less likely to be homeowners than those who had used mortgages. Only 64% of people who had used a lease-purchase agreement in the past said they owned their home in 2021, compared with 80% of those who had previously used a mortgage. So, although these agreements enable homeownership for some prospective buyers, most would be better served by a mortgage.

- Lease-purchase buyers often assume the costs and responsibilities of homeowners, but without comparable protections. Would-be homebuyers are often responsible for paying property taxes and making home repairs, even during their rental periods. And yet, when disputes arise with the seller, many lease-purchase buyers end up in landlord-tenant court, where they can be evicted and are often not credited for their down payment or other equity investments.

- The lack of a clear legal framework in most states means that lease-purchase buyers often get inconsistent legal protection. Just five states have laws specifically governing lease-purchase agreements, and the provisions of those laws vary widely. The lack of clear rules creates opportunities for sellers to take advantage of would-be buyers.

Households use lease-purchases when mortgages are hard to get

Homebuyers who don’t have enough cash to buy their property outright must instead rely on some form of financing. Pew estimates that 51.1 million U.S. households were financing a home purchase in 2021, including 47.7 million (93.4%) who were using a mortgage, 1.1 million (2.1%) who had signed a lease-purchase agreement, and 2.3 million (4.5%) who were using some other form of alternative financing.

Pew’s survey found that lease-purchase agreements were most often used by groups that have historically struggled to get a mortgage. For example, 8.1% of survey respondents with household incomes of $50,000 or less were using a lease-purchase agreement in 2021, compared with 0.9% of those earning more than $50,000. Households led by a Black or Hispanic person, or by someone under 30, were also more likely than the population as a whole to use lease-purchases. (See Figure 1.)

Americans seeking to purchase something other than a single-family home also often used lease-purchase agreements. Pew’s survey found that 12.1% of those buying a unit in a multifamily building—including “duplexes, condominiums, and apartments” in survey questions—were using lease-purchases in 2021, compared with 1.1% of those living in site-built single-family homes. Similarly, about 4.6% of those purchasing manufactured homes were using a lease-purchase agreement.

Potential buyers of manufactured homes and multifamily units use lease-purchase agreements at a higher rate because it’s often difficult to get mortgage financing for these types of properties. Research shows that denial rates for manufactured home loans far exceed those for traditional site-built homes; similarly, numerous barriers make it difficult for lenders to extend credit to those seeking to purchase a condo or a similar unit in a multifamily building.4

Lease-purchase buyers are less likely to be homeowners than mortgage holders

Although lease-purchase agreements are used by households that might struggle to get a mortgage, it remains unclear whether these agreements expand homeownership. The available data shows that some lease-purchase buyers successfully exercise their option contract, but homeownership rates are lower than for households that used a traditional mortgage. That difference is due in part to the fact that mortgagees become homeowners on the day they sign their loan contract, whereas lease-purchase buyers remain tenants until they exercise their option to purchase and close on a mortgage for the home.

Still, when Pew analyzed the survey responses of homebuyers who had completed their financing arrangements, just 64% of those who had previously used a lease-purchase agreement owned a home in 2021. In contrast, 80% of those who had used a mortgage were homeowners at the time they completed the survey. (See Figure 2.) Users of both financing types sometimes returned to being renters, sometimes because they sold their homes and sometimes because they went through foreclosure when they were unable to make payments. And some lease-purchase buyers entered into a residential lease but did not exercise their option to purchase, contributing to the lower homeownership rate in 2021.

Three prominent lease-purchase companies in the U.S. have also released data on their homeownership conversion rates, which range from 22% to 71%.5 However, these companies operate on a limited scale and only in select markets, which makes it difficult to assess whether these reported homeownership conversion rates are representative.

The likelihood that a lease-purchase buyer converts to homeownership depends on several factors. One is a household’s credit-readiness. Data from one lease-purchase company shows that its typical enrollee has a credit score of 640 and a household income of $131,000.6 Based on these financial characteristics, many lease-purchase buyers might have qualified for a home loan from the Federal Housing Administration, which insures nearly one-quarter of its loans to borrowers with credit scores below that threshold.7 Unsurprisingly, data from the same company shows that lease-purchase tenants with credit scores above 620 are more likely to exercise their option contracts than those with scores below 620.8

Homeownership conversion rates are also affected by the costs and terms of the option contract. Some sellers include provisions like balloon payments—large one-time payments near the end of the contract term—as a way of reducing the likelihood that tenants will exercise their option contract. In Pew’s 2022 survey of 193 individuals who had used or were currently using a lease-purchase agreement, 20% said their agreement had a balloon payment listed or disclosed. Further, about two-thirds of respondents reported that their contract did not set a purchase price, meaning that the price could later be unilaterally increased by the seller. In interviews with Pew researchers, legal aid attorneys noted that some prospective buyers successfully made payments for years, only to discover at the end of their contract that the final purchase price exceeded what they had budgeted for.

Lease-purchases exist in a legal gray area between renting and owning

Because of the two-part structure of a lease-purchase agreement, buyers who use the agreements often exist in a legal gray area between renters and homeowners. Many lease-purchase buyers believe they’re entering into a contract to purchase a home, which makes them willing to accept many of the costs and responsibilities that accompany homeownership. But they don’t receive the benefits of homeownership unless they exercise their option to purchase.

In Pew’s 2022 survey, for example, many lease-purchase buyers reported that they were responsible for paying property taxes and handling home repairs during the rental portion of their agreement, even though state laws typically require landlords to pay such costs. Forty percent of lease-purchase buyers reported being responsible for paying property taxes and 14% reported having to pay for major repairs—responsibilities that make lease-purchases more costly than standard rental agreements without increasing the prospective buyer’s home equity or improving the chance of converting to homeownership.

At the same time, lease-purchase buyers face all the same challenges as renters—and sometimes more. Many pay monthly rents that are above market rate, either because the seller requires them to set aside extra money each month for a future down payment or because sellers set monthly payments based on the cost of a mortgage, which in hotter housing markets is higher than rents.9 Additionally, many lease-purchase buyers are required to pay a down payment or “option fee” before signing their lease. These fees typically exceed the cost of a security deposit and are sometimes nonrefundable, meaning that lease-purchase buyers forfeit their initial investment if they don’t exercise their option to purchase.10

The legal murkiness of these agreements is most evident when a dispute arises between the lease-purchase buyer and the seller, and the two sides end up in court. Most states treat lease-purchase buyers as renters, which means that disputes are resolved in landlord-tenant court and buyers are at risk of eviction when they can’t make all necessary payments. However, because these courts typically handle standard rental eviction cases, lease-purchase buyers rarely get credit for any down payment or option fee they’ve made, depriving them of a major investment.

In contrast, a few states treat lease-purchase buyers like homeowners with a mortgage when disputes wind up in court. In Florida, for example, attorneys and judges have interpreted state law in a way that groups lease-purchase agreements with other methods of real estate financing.11 As a result, lease-purchase buyers often go through foreclosure, rather than eviction proceedings, if problems arise. When cases are heard in a circuit court that handles foreclosure matters, rather than a landlord-tenant court, lease-purchase buyers are more likely to receive credit for their option fee and any savings toward a down payment, less overdue rent.

Few states have laws specifically governing lease-purchase agreements

Despite the clear risks and uncertain benefits of lease-purchase agreements, few states have laws specifically governing these arrangements. As a result, although every state has landlord-tenant laws governing residential leases, it’s not always clear to courts and local governments that these statutes apply to lease-purchases. Further, these laws typically fail to recognize that lease-purchase buyers have any ownership stake in the property, even if they made a down payment or handled common homeownership responsibilities.

Just five states—Maine, Maryland, North Carolina, Texas, and Virginia—have laws that directly regulate lease-purchase agreements.12 But even among these states, protections vary widely. (See Table 1.)

In the Few States That Directly Regulate Lease-Purchase Agreements, Protections Vary Widely

| State | Clarifies that landlord-tenant law applies? | Requires sellers to disclose terms of option contract? | Requires sellers to publicly record option contract? | Gives buyers more time than renters to catch up on missed payments? | Allows buyers to automatically recoup at least some of their upfront payments? |

|---|---|---|---|---|---|

| Maine | No | Yes | Yes | Sometimes | Yes |

| Maryland | Yes | No | No | No | No |

| North Carolina | Yes | Yes | Yes | Yes | No |

| Texas | Yes | Yes | Sometimes | Yes | Sometimes |

| Virginia | Yes | No | No | Yes | Yes |

Note: Texas only requires lease-purchase agreements with terms longer than three years to be recorded. Further, sellers in Texas are not allowed to withhold option fees from buyers who miss payments, but may be able to withhold them for other reasons.

Sources: NCLC scan of state laws that specifically govern lease-purchase agreements; conversations with state legal aid attorneys; Pew analysis of state lease-purchase and landlord tenant laws.

Among states with laws specifically governing lease-purchases, the most common provision involves clarifying that these arrangements fall under the purview of landlord-tenant law during the lease period. Other common protections include requiring sellers to more clearly disclose contract terms (such as sales price) to lease-purchase buyers; requiring sellers to publicly record option contracts with local governments; giving lease-purchase buyers the right to catch up on missed payments (a process known as curing); and affirming that lease-purchase buyers are entitled to credit for, or the return of, their down payment or option fee even if they choose not to buy the property or fail to make all necessary payments.

Additionally, a provision in Texas’ lease-purchase law requires agreements with terms longer than three years to be covered by the state’s land contract statute. In Texas, land contracts— another form of alternative financing—have historically been subject to more stringent consumer protections than lease-purchase agreements. To avoid these stricter requirements, some sellers began offering financing arrangements that were structured like a land contract but described using the terms “lease-purchase” or “rent-to-own.” In interviews, legal aid attorneys reported similar cases in several states across the country, but so far only Texas has passed laws to curb this behavior.

Conclusion

Sellers often promote lease-purchase agreements as a pathway to homeownership, but this often does not happen. And the contract can pose significant risks to would-be buyers. During the residential lease period, lease-purchase buyers frequently take on the costs and responsibilities of homeowners, but without the equity and foreclosure protections afforded to mortgagees. Contracts often fail to include vital basic information, such as a purchase price, and many contain risky features such as balloon payments, which make it difficult for buyers to exercise the option and purchase the home. As a result, many lease-purchase buyers fail to convert to homeownership.

Aspiring homebuyers who rely on lease-purchase agreements belong disproportionately to groups that often struggle to get mortgage financing. They include low-income, Black, and Hispanic homebuyers, and those buying manufactured homes or units in multifamily buildings. Many of these buyers use lease-purchase agreements out of necessity but would be better served by a standard mortgage—if one were available to them.

States could play a role in regulating these arrangements, but few have done so. Just five states have laws specifically governing lease-purchase agreements, and even these laws offer buyers an incomplete set of consumer protections. Policymakers seeking to improve homeownership opportunities could consider strategies that establish baseline protections for lease-purchase agreements while also making mortgages more available. Doing so would help ensure that homeownership is affordable and attainable for Americans across the country.

Acknowledgments

This brief was researched and written by Pew staff members Linlin Liang and Adam Staveski. The authors thank Pew colleagues Travis Plunkett, Seva Rodnyansky, Tara Roche, Gabriela Domenzain, Laurie Boeder, Carol Hutchinson, and Omar Antonio Martínez for providing communications, creative, editorial, and research support for this work.

Endnotes

- “Can Lease-Purchase Arrangements Provide Another Pathway to Homeownership?,” Linlin Liang and Dennis Su, The Pew Charitable Trusts, Dec. 5, 2024, https://www.pewtrusts.org/en/research-and-analysis/articles/2024/12/05/can-lease-purchase-arrangements-provide-another-pathway-to-homeownership. The Pew Charitable Trusts, “Millions of Americans Have Used Risky Financing Arrangements to Buy Homes,” 2022, https://www.pewtrusts.org/en/research-and-analysis/issue-briefs/2022/04/millions-of-americans-have-used-risky-financing-arrangements-to-buy-homes. The Pew Charitable Trusts, “Home Financing Incidence Survey,” 2021, https://www.pewtrusts.org/-/media/assets/2022/04/incidence-survey_topline.pdf.

- Michael Stegman, Jeb Mason, and Mark Zandi, “Lease-to-Purchase: How to Build Homeownership,” Moody’s Analytics, 2022, https://www.moodys.com/web/en/us/insights/resources/lease-to-purchase-how-build-homeownership.pdf. Carol Galante, Carolina Reid, and Rocio Sanchez-Moyano, “Expanding Access to Homeownership Through Lease-Purchase,” Terner Center for Housing Innovation, 2017, https://ternercenter.berkeley.edu/wp-content/uploads/pdfs/lease-purchase.pdf.

- Business Insider, “Private Equity Sold Them a Dream of Home Ownership. They Got Evicted Instead,” 2023, https://www.businessinsider.com/home-partners-rent-to-own-low-success-rate-2023-5. Ainsley Harris, “Inside the Rent-to-Own Startup That’s Putting Aspiring Homeowners in Financial Jeopardy,” Fast Company, 2022, https://www.fastcompany.com/90795531/divvy-real-estate-venture-capit. Matthew Goldstein, “New York State Officials Sue ‘Predatory’ Rent-to-Own Home Seller,” The New York Times, Aug. 1, 2019, https://www.nytimes.com/2019/08/01/business/rent-to-own-vision-lawsuit.html. Alexandra Stevenson and Matthew Goldstein, “Rent-to-Own Homes: A Win-Win for Landlords, a Risk for Struggling Tenants,” The New York Times, Aug. 21, 2016, https://www.nytimes.com/2016/08/22/business/dealbook/rent-to-own-homes-a-win-win-for-landlords-a-risk-for-struggling-tenants.html.

- “Data Shows Lack of Manufactured Home Financing Shuts Out Many Prospective Buyers,” Linlin Liang, Rachel Siegel, and Adam Staveski, The Pew Charitable Trusts, Dec. 7, 2022, https://www.pewtrusts.org/en/research-and-analysis/articles/2022/12/07/data-shows-lack-of-manufactured-home-financing-shuts-out-many-prospective-buyers. Jodi Horne, “Lenders Identify Risks and Opportunities for Condo Lending,” Fannie Mae, Feb. 21, 2024, https://www.fanniemae.com/research-and-insights/perspectives/lenders-identify-risks-and-opportunities-condo-lending.

- From 2012 to 2021, Home Partners of America enrolled 19,455 participants in its lease-purchase program, of which 4,365 (22%) successfully converted to homeownership. Trio had 119 participants in its program from 2001 to 2021 and converted 85 (71%) of them to homeowners. Divvy reported that from 2017 to 2021, roughly 40% of its participants have exercised their option contract. Michael Stegman, Jeb Mason, and Mark Zandi, “Lease-to-Purchase: How to Build Homeownership.” Divvy Homes, “Divvy Homes Closes $200 Million Series D to Broaden Access to Homeownership,” news release, Aug. 13, 2021, https://www.prnewswire.com/news-releases/divvy-homes-closes-200-million-series-d-to-broaden-access-to-homeownership-301355103.html.

- Michael Stegman, Jeb Mason, and Mark Zandi, “Lease-to-Purchase: How to Build Homeownership.”

- Federal Housing Administration, “FHA Single Family Origination Trends,” U.S. Department of Housing and Urban Development, 2024, https://www.hud.gov/sites/dfiles/Housing/documents/FHAOT_Nov2024.pdf.

- Michael Stegman, Jeb Mason, and Mark Zandi, “Lease-to-Purchase: How to Build Homeownership.”

- TechEquity Collaborative, “Rent to Own the American Dream: The Promises and Perils of Alternative Home Financing,” 2022, https://techequity.us/2022/11/01/rent-to-own-the-american-dream-paper/.

- TechEquity Collaborative, “Rent to Own the American Dream: The Promises and Perils of Alternative Home Financing.”

- State of Florida, Statute 697.01 Instruments Deemed Mortgages, http://www.leg.state.fl.us/Statutes/index.cfm?App_mode=Display_Statute&Search_String=&URL=0600-0699/0697/Sections/0697.01.html.

- Maine Revised Statutes, https://legislature.maine.gov/statutes/14/title14sec6203-H.html. Maryland Statutes—Real Property, 2024, https://law.justia.com/codes/maryland/real-property/title-8/subtitle-2/section-8-202/. North Carolina General Statutes, https://www.ncleg.net/enactedlegislation/statutes/pdf/bychapter/chapter_47g.pdf. Texas Property Code, https://statutes.capitol.texas.gov/Docs/PR/htm/PR.5.htm. Code of Virginia, https://law.lis.virginia.gov/vacodefull/title55.1/chapter30/.