Debt Collection Lawsuits Surge to Pre-Pandemic Highs

Data shows that filings skyrocketed in the past two years in urban and rural areas

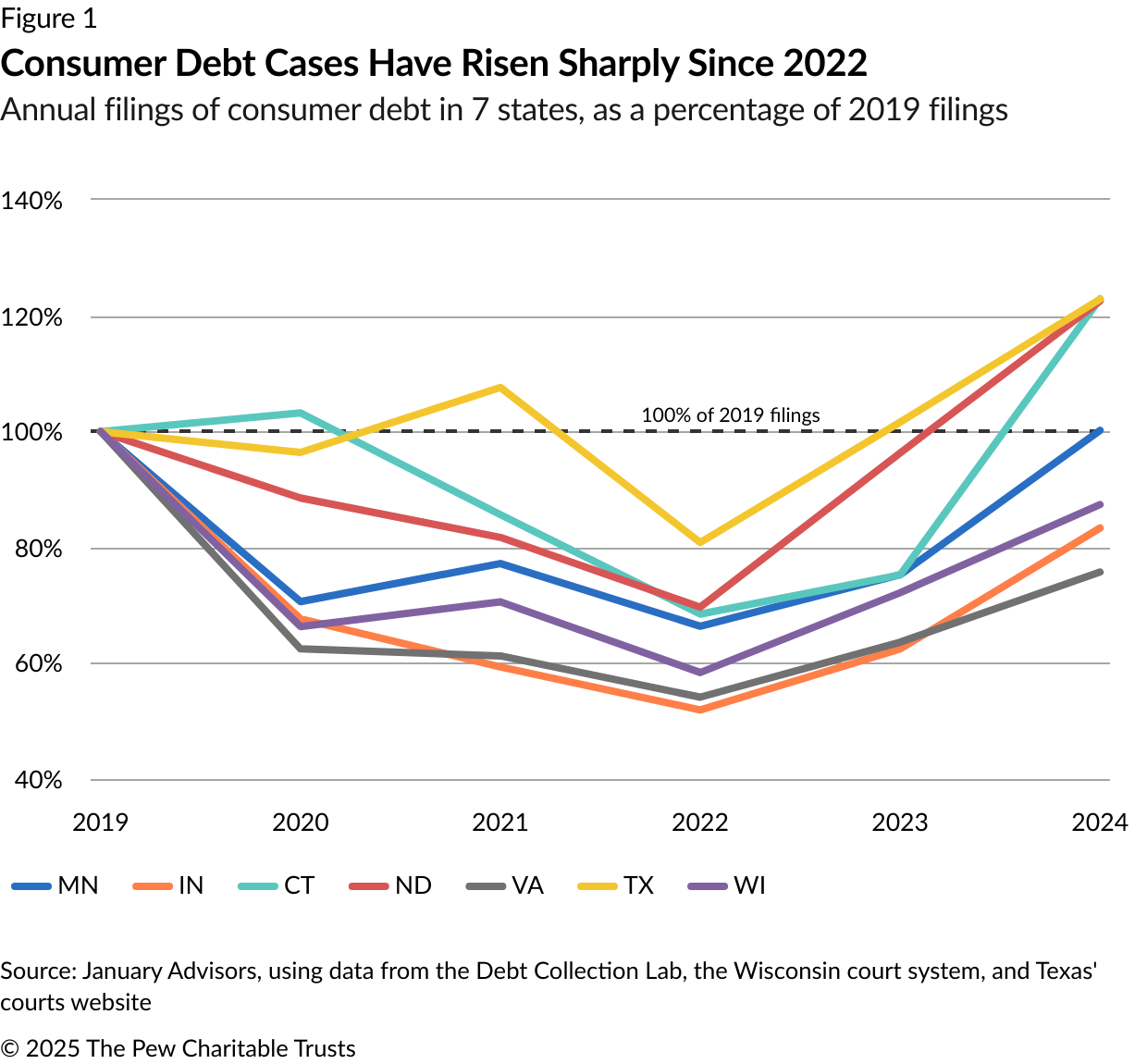

State courts nationwide are grappling with spikes in debt collection lawsuits, according to two new reports from January Advisors and the National Center for State Courts (NCSC). Debt collection lawsuits account for a notable share of civil dockets in the United States each year, with up to 4.7 million cases filed in 2022, according to Pew calculations. Although claims slowed during the pandemic, recent data shows a sharp uptick in filings in 2023 and 2024—in many instances surpassing pre-pandemic levels.

This increase in debt claims signals an urgent need for court leaders and policymakers to reform court processes to ensure that all cases are valid and that the right person is sued for the right amount. Without changes in laws or policies, the rise in debt cases may further congest already overcrowded civil court dockets, lead to judgments that can haunt people for decades, and impose considerable financial consequences for the 1 in 4 adults with a debt in collections.

Although nationwide data is not readily available, the case-level data—reviewed by consulting firm January Advisors from statewide filings in Minnesota, Missouri, Indiana, North Dakota, Connecticut, and Virginia—helps flesh out the broader picture. (See Figure 1). This research also includes major metropolitan areas such as Houston, Austin, Dallas, Maricopa County in Arizona, and Philadelphia. The surge observed in debt cases in 2023 and 2024 holds true across both rural and urban areas, including rural North Dakota and densely populated Maricopa.

Similarly, a report released in June by NCSC identified the recent rise in debt claims and hypothesized that it was partially due to artificial intelligence, or AI. Researchers found that for cases involving contracts (which can include debt lawsuits, foreclosure, and landlord-tenant cases), filings increased 21% in 2022 and 15% in 2023 from the years prior, and pointed to how the use of AI could make filing more complaints easier for debt collectors. Despite similar economic conditions, all other civil case types did not experience the same increases.

Top filers are filing more cases

Businesses initiate lawsuits against a consumer for an alleged debt owed. In states with available data—for example, Utah, Minnesota, and Michigan—historically about half of all debt collection cases are for less than $2,000, and the most common sources are credit card or bank debt and medical debt. A handful of national companies, such as debt buyers and banks, file the bulk of cases and help account for the recent surge. (See Figure 2).

Figure 2

State Data Shows Burden on Courts From Top Filers Grew From 2019 Through 2024

Last year, 10 plaintiffs accounted for 80% of the debt docket in Connecticut

| Share of cases filed by the top 10 plaintiffs | |||

|---|---|---|---|

| State | 2019 | 2024 | Percent Change |

| Indiana | 27.7% | 47.4% | 71.4% |

| Connecticut | 63.9% | 80.2% | 25.6% |

| Virginia | 31.4% | 47.4% | 50.7% |

| Minnesota | 53.2% | 66.4% | 24.7% |

| Wisconsin | 37.4% | 49.2% | 31.4% |

| North Dakota | 66.7% | 67.9% | 1.9% |

Notes: This table tracks the percentage of the docket that the top 10 filers—generally debt buyers and banks—were responsible for in 2019 and 2024. The businesses in 2019 may not be exactly the same in 2024 because researchers looked at the aggregate number of filings by the top 10 companies, not the individual companies. Also, Texas is not included because January Advisors pulls that state’s aggregate numbers, not its individual filings.

Source: January Advisors, using data from the Debt Collection Lab and the Wisconsin court system

In Indiana, for instance, the portion of the debt docket filed by the top 10 filers nearly doubled between 2019 and 2024. The analysis of these states by January Advisors shows that one national debt buyer in particular—LVNV Funding—increased filings by 350% for the same period.

Consequences of lawsuits can be profound

People who are sued for consumer or medical debt navigate these lawsuits on their own—consumers are represented in fewer than 10% of cases (or as low as 0.6%), and most often do not come to court or participate in the case against them because court processes can be confusing or they may not understand why they have been sued. Courts are left to issue judgments without any examination of the facts. Recent studies in Connecticut, California, and Minnesota show that even when required, court officials may not review whether a claim is valid, how much is owed, or whether the right person is being sued.

Once a court issues a judgment, that judgment carries with it the full enforcement power of the court, including the authority for a business to garnish a consumer’s assets or wages. In 35 states and in Washington D.C., a judgment levied against people in a debt lawsuit can follow them for at least a decade—and in 18 of those jurisdictions, a financial judgment can be renewed if not paid off. The repercussions, therefore, can be severe. Given the consequences, it is crucial that courts check the validity of all cases and implement policies that encourage people to participate in the legal process.

Policymakers can reshape debt litigation in the courts

Although court administrators and judges decide how matters before the court should be handled, legislators make the laws that determine the range of issues that can be considered and how cases progress in the system. As more people find themselves being sued for debts, policymakers can implement simple solutions to make sure that people in their communities can participate in their cases—such as by removing legal barriers such as requiring written answers or fees to file those answers, improving and reviewing disclosures, and making post-judgment protections automatic.

These practical solutions could ensure that the rising number of lawsuits being entered into court dockets are valid and that people know what they are being sued for and for how much. Implementing such policies can also help more people without attorneys to actively participate in their cases. If applied nationwide, these reforms could allow more people to pay back their debts and ensure that courts are achieving their vision of equal and fair treatment for all.

Lester Bird is a senior manager and Casey Chiappetta is an officer with Pew’s courts and communities project.