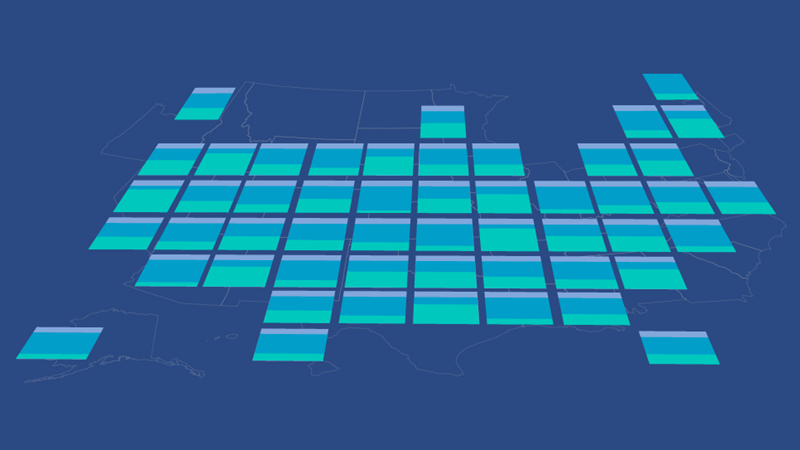

Where States Get Their Money

FY 2020

Note: this data has been updated.

Pandemic relief aid increased the portion of state government revenue coming from federal dollars to nearly 36% in fiscal year 2020, the highest level on record. The federal share of revenue hit new highs in most states. Federal funds were the largest source of dollars in 18 states, up from just four states a year earlier. Taxes remained the largest revenue source in the other 32 states and overall, at 45.8% of state revenue.

This infographic displays a breakdown of each state’s revenue by major categories.