States Hold the Keys to Greater Mortgage Access for Manufactured Home Buyers

Updates to real estate titling laws could reduce costs and complexities for borrowers

Overview

Manufactured homes could help address the nation’s critical housing shortage, but outdated state laws often prevent manufactured home buyers from obtaining a mortgage, thus limiting the reach of one of the nation’s most affordable types of housing and forcing borrowers to pay tens of thousands of dollars in additional financing costs.

State laws determine a manufactured home’s titling status, which affects how it is owned, financed, taxed, and sold. Homes titled as real estate (also known as “real property”) are eligible for mortgages, which come with a range of consumer protections and are usually the lowest-cost financing option available. Homes titled as personal property are ineligible for mortgages, leaving buyers with more expensive options, such as “home-only” loans (also known as “personal property” or “chattel” loans), that have fewer legal protections. An analysis by The Pew Charitable Trusts shows that a $100,000 mortgage will save a typical borrower roughly $49,000, compared with home-only financing, over the life of the loan. In addition, mortgage borrowers pay 10% less per month than if they had used a home-only loan.

Many states restrict the circumstances under which manufactured homes can qualify for real estate titling. For example, most states automatically title new manufactured homes as personal property; a manufactured home is treated as real estate only if it is affixed to a permanent foundation, it is located on land owned by the buyer, and the buyer proactively converts it from personal to real property. Some states also have legal or procedural barriers that make it difficult for a homeowner to change a property’s titling status once it has been established. In part due to these barriers, about 88,000 borrowers used a home-only loan between 2018 and 2024 even though they also owned their land and were most likely eligible for a mortgage.

Policymakers could lower costs for manufactured home buyers by updating state titling laws. One approach would be to automatically title a manufactured home as real estate if the buyer owns the land on which it is located, making it simpler for a borrower to use a mortgage. Another option would be to extend real estate titling to buyers who are not currently eligible, such as those who live in resident-owned communities, on Tribal land, or on land owned by a family member. Both strategies would expand mortgage access, reduce borrower costs, and boost consumer demand for one of the nation’s lowest-cost housing types.

Manufactured homes can help fix the nation’s housing shortage

The United States faces a severe and persistent shortage of homes. Estimates suggest the country is short between 1.5 million and 7.1 million housing units, which has contributed to rising rents and home prices in communities nationwide.1 Meeting this demand will require policymakers and housing industry leaders to take a fresh look at modern manufactured homes, which are affordable to produce, fast to install, and usable in a range of settings and locations.

Because they are built in a factory, manufactured homes require less labor to produce than standard site-built homes. According to one study, the cost savings are between 27% and 65%, depending on the size and type of home.2 These savings help buyers: The average cost per square foot of a manufactured home is roughly half that of a site-built home.3 Because of their affordability, manufactured homes have become popular in a wide range of settings and locations—on vacant city lots, in new suburban subdivisions, and on rural plots of land owned by families and Tribes.

Modern manufactured homes also must conform to federal building standards administered by the Department of Housing and Urban Development.4 These standards—which cover durability, energy efficiency, ventilation, fire safety, and structural performance—ensure that today’s manufactured homes are high-quality, long-lasting, and comparable in safety to site-built homes. Despite advances in safety and quality, however, many state and local laws still regard manufactured homes like trailers of the past, restricting where they can be sited and how they can be financed. Updating state titling laws could unlock the potential of manufactured homes to help close the nation’s housing supply gap.

State laws often treat manufactured homes like cars, not houses

In legal terms, “personal property” refers to objects that are movable—such as a car, boat, or piece of furniture—whereas “real estate” describes immovable possessions like land and homes permanently affixed to land.5 Although every state automatically titles site-built homes as real estate, manufactured homes are commonly titled as personal property due to outdated policies that treat these homes more like cars than housing units. But modern manufactured homes are often indistinguishable from site-built houses, which means it is often challenging and costly ($5,000 to $20,000) to move them from their original location.6

Still, most states title manufactured homes as personal property by default.7 Laws often limit real estate titling to homes that are set on a permanent foundation, the definition of which varies by state. In addition, borrowers are typically required to own the land on which the home is located. The intent of these rules may be to ensure that manufactured homes are functionally equivalent to site-built homes. However, even when buyers meet the necessary legal requirements, states often regard manufactured homes as personal property unless buyers opt into real estate titling, and they or their lender take additional steps to complete that process.

Once a manufactured home’s title is registered, it can be hard to change. Homeowners seeking to convert their homes from personal property to real estate (a process known as “detitling”) often run into complicated and time-consuming procedural barriers. For example, many states require a homeowner to initiate legal filings, undergo home inspections, or—in extreme cases—go to court to change the title on a home from personal property to real estate. In addition, some states require those with home-only loans to pay off the entire loan before changing a home’s titling status, making it all but impossible for borrowers to save money by refinancing from a home-only loan to a mortgage.8

Together, legal limitations and procedural complexity dissuade some manufactured home buyers from titling their manufactured homes as real estate even if they are eligible to do so. For example, landownership is one of the most common requirements for real estate titling, but a 2022 survey of manufactured home residents conducted by Pew found that 25% of landowners had personal property titling.9 Pew’s survey asked those landowners whether they could convert their home to real estate titling if they wanted to do so: 46% did not know, 38% said they could, and 16% said they could not. These results suggest that while some landowners choose to own their home as personal property, the majority either don’t know their options or are excluded from converting to real estate titling because of other requirements.

Home titling affects a buyer’s financing options

A manufactured home’s titling status determines whether it can be financed with a mortgage. Homes titled as real estate are eligible to get mortgages, whereas those titled as personal property are not. Since landownership is typically a prerequisite for real estate titling, most site-built and manufactured home mortgages are secured by both a house and land. However, in some cases, a mortgage can be secured by a home only. For example, community land trusts enable buyers to get home-only mortgages by offering long-term ground leases that give the buyer land stability without land ownership.10 And a law enacted in New Hampshire in 1983 automatically titles all manufactured homes connected to utilities as real estate, enabling borrowers to access mortgages regardless of whether they own the land.11

Mortgages benefit borrowers because they come with a range of consumer protections. For example, federal law requires mortgage lenders to clearly disclose loan terms, prohibits lenders from steering borrowers to products or providers that offer the lender higher compensation, and protects borrowers’ equity if they do not make all payments. And state laws outline how buyers must be treated if they cannot make all necessary payments and the lender initiates foreclosure proceedings.

In contrast, a manufactured home titled as personal property can only be financed with a home-only loan from an outside lender or contract financing (in which case payments often go directly to the seller, as in rent-to-own agreements or contracts for deed).12 Home-only loans can be a good option for some buyers, but they offer fewer consumer protections than mortgages.13 For example, many states allow home-only lenders to quickly repossess a property if the borrower does not make all necessary payments, rather than going through the foreclosure process, which has been shown to help borrowers stay in their homes.14 In addition, home-only loans are typically ineligible for government-backed loan programs, contributing to high denial rates.15

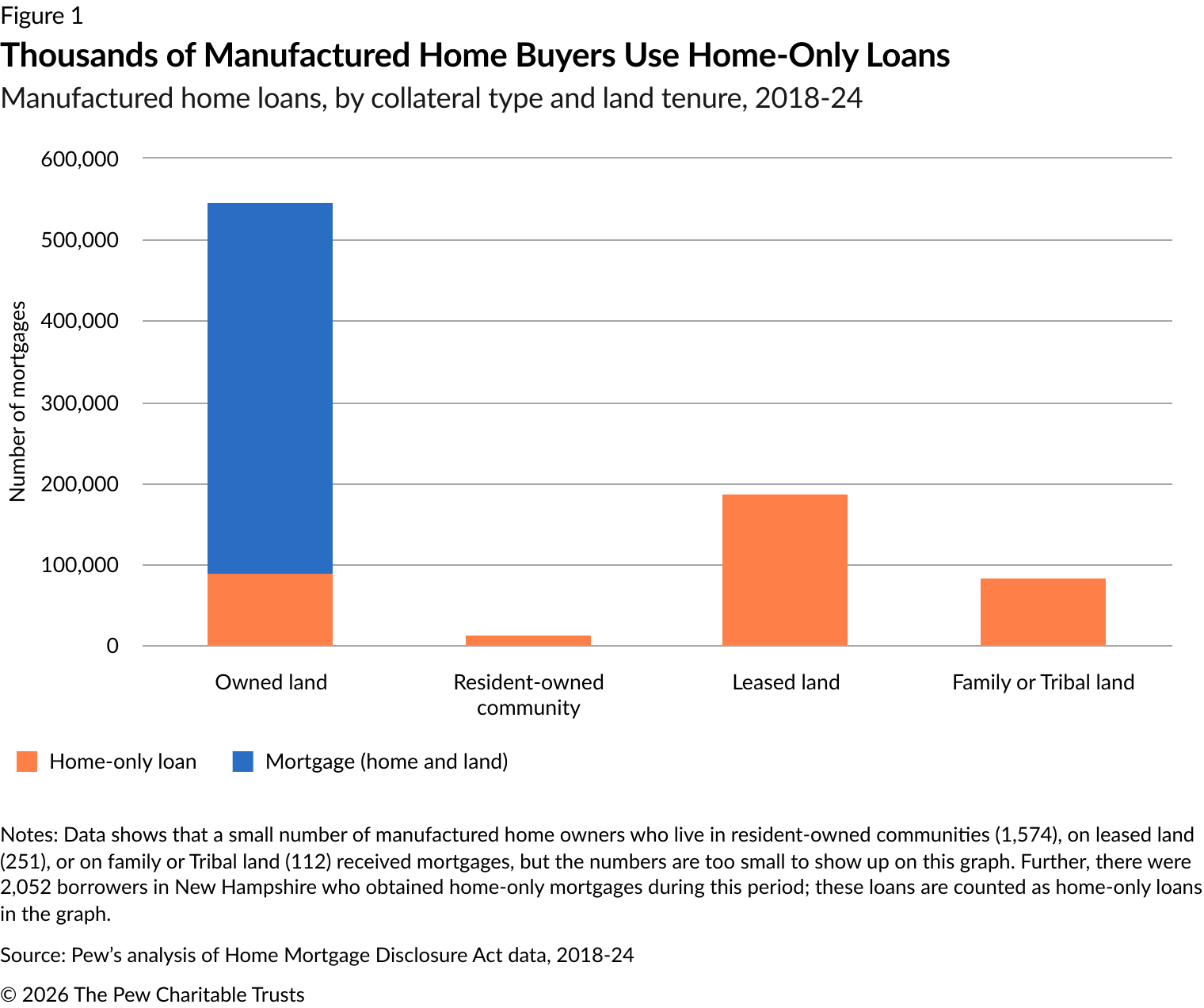

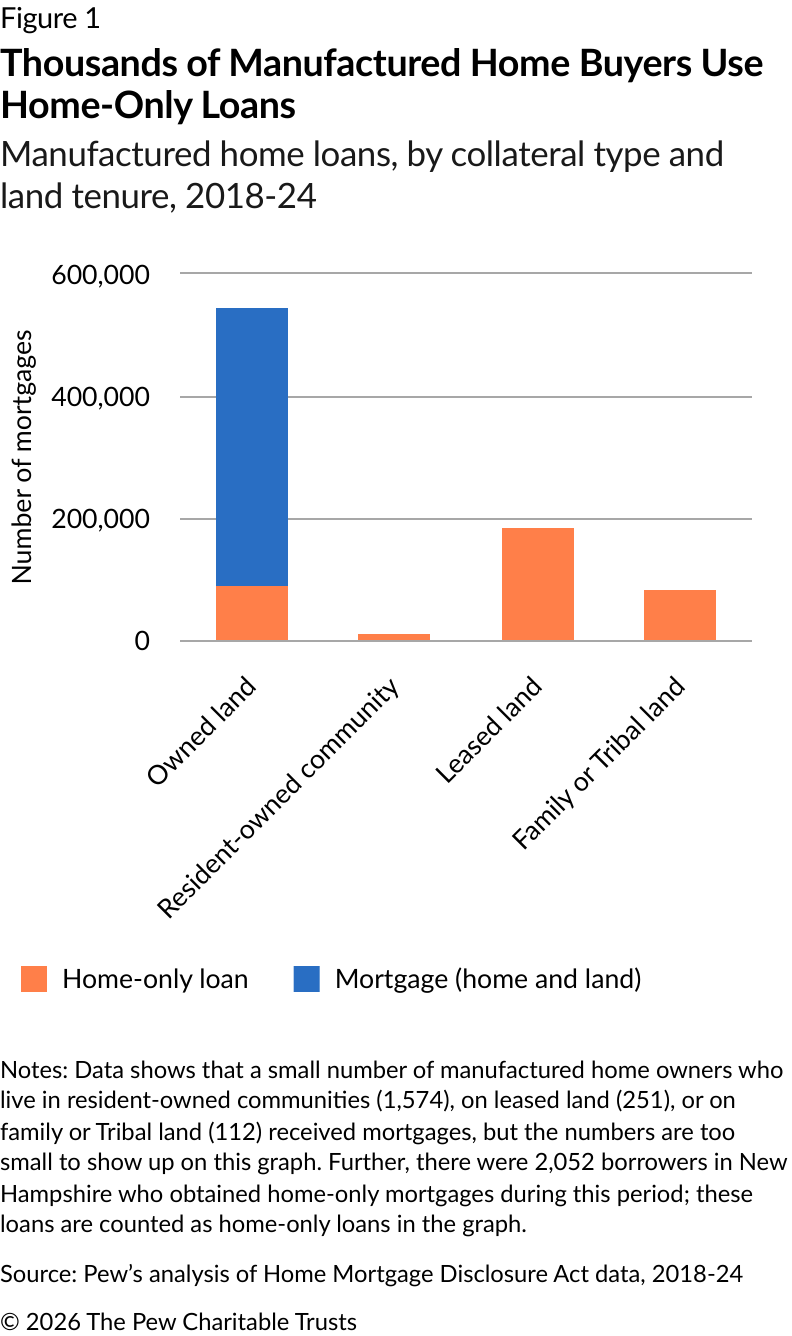

From 2018 to 2024, about 366,000 manufactured home buyers (44% of those who borrowed money) used a home-only loan to finance their purchase, while 459,000 (56%) used a mortgage. (See Figure 1.) Buyers’ use of financing was closely linked to their land tenure: Those who leased their land, lived in a resident-owned community, or lived on family or Tribal land almost always used a home-only loan, while those who owned the land most often used a mortgage. Still, at least 88,000 landowners used home-only loans even though they were likely eligible for a mortgage.

Mortgages save borrowers thousands of dollars in loan costs

For borrowers, home titling directly affects loan eligibility and thus affordability. The median interest rate on a home-only loan was 8.5% between 2018 and 2024, compared to a median of 5.4% for manufactured home mortgages—differences that were not due to borrowers’ financial characteristics.16 (See Table 1.) And whereas most mortgages have 30-year repayment periods, home-only loans typically have 23-year terms, further increasing a borrower’s monthly payments.

To estimate the effect of higher interest rates and shorter loan terms on borrowing costs, Pew calculated the monthly and total payments a borrower would make for a manufactured home mortgage and a home-only loan at the median interest rate and loan term. A mortgage borrower with a $100,000 loan would pay $562 per month, compared with $826 per month for a home-only loan borrower. Over the life of the loan, the mortgage borrower would save more than $25,000. In other words, the mortgage borrower saves 32% on the monthly payment and 11% over the life of the loan, compared with a home-only personal property loan borrower with the same loan amount.

Mortgages Save Borrowers Tens of Thousands of Dollars Over the Life of the Loan

Median interest rate, loan term, and payments for a $100,000 loan

|

Median interest rate |

Loan term |

Monthly payment |

Total cost |

|

|---|---|---|---|---|

|

Manufactured home mortgage |

5.40% |

360 months (30 years) |

$561.53 |

$202,151 |

|

Home-only loan |

8.50% |

276 months (23 years) |

$826.09 |

$228,001 |

|

Savings |

3.10% |

$264.56 |

$25,850 |

Notes: The data is for originated loans covering single-family, owner-occupied manufactured homes. Pew calculations used a standard amortization table.

Source: Pew’s analysis of Home Mortgage Disclosure Act data, 2018-24

The cost comparisons in Table 1 do not account for differences in collateral across loan types (whether a borrower secures the loan with a home and land or only a home). To better understand how titling affects loan costs when the borrower offers only the home as collateral, Pew examined the experience of borrowers in New Hampshire, the one state where borrowers can get a mortgage secured only by a manufactured home, rather than a home and land together.17 From 2018 through 2024, 61% of manufactured home borrowers in New Hampshire took out home-only mortgages, which use just the home as collateral but have the same consumer protections as any other mortgage.

Home-only mortgages in New Hampshire had lower interest rates, had lower monthly payments, and cost less overall than home-only loans in other parts of the United States. (See Table 2.) Based on the median interest rate and loan term in New Hampshire, Pew calculated that a home-only borrower there paid about $746 per month for a $100,000 loan, compared with the national average of $826. Not only is the monthly payment lower, but the repayment period is also shorter in New Hampshire than in the rest of the country, so borrowers made fewer payments. In all, they saved about $49,000 over the life of the loan, compared with home-only borrowers in the rest of the country. Further, home-only mortgage borrowers in New Hampshire save nearly 10% on their monthly payments compared with other home-only personal property loan borrowers.

Home-Only Loans in New Hampshire Are More Affordable Than in Other Parts of the U.S.

Median interest rate, loan term, and payments for a $100,000 loan

|

Median interest rate |

Loan term |

Monthly payment |

Total cost |

|

|---|---|---|---|---|

|

New Hampshire |

6.50% |

240 months (20 years) |

$745.57 |

$178,937 |

|

United States |

8.50% |

276 months (23 years) |

$826.09 |

$228,001 |

|

Savings |

2.00% |

$80.52 |

$49,064 |

Notes: The data is for originated home-only loans covering single-family, owner-occupied manufactured homes. Pew calculations used a standard amortization table.

Source: Pew’s analysis of Home Mortgage Disclosure Act data, 2018-24

Updates to titling laws could lower costs for borrowers nationwide

State policymakers could lower costs and improve protections for manufactured home buyers by passing laws that make it easier for borrowers to choose real estate titling. To start, states could automatically title homes as real estate when borrowers own or finance the land beneath their homes—a policy change that could extend mortgage access to some 88,000 homebuyers over seven years, based on the experience of borrowers from 2018 to 2024. Likewise, states could eliminate or reduce requirements imposed on those who own a manufactured home and land and want to change their home’s titling status.

Policymakers could also expand real estate titling to buyers who do not own their land but have stable land tenure. In recent years, several state and federal programs have sought to expand mortgage access to those who do not own their land:

- Washington state recently enacted legislation that enables buyers who live in resident-owned communities to title their homes as real estate.18

- New York state legislators passed a bill in 2025 that would allow manufactured home buyers to title their homes as real estate, regardless of land tenure, if their home is installed on a permanent foundation and they receive permission from the landowner.19

- Fannie Mae’s policies allow it to purchase mortgages made to borrowers who live in resident-owned communities and on land owned by community land trusts.20 The government-controlled company is also considering changes that would enable it to purchase mortgages made to borrowers who live on rented land with long-term leases.21

- Freddie Mac now purchases mortgages for manufactured homes located on Tribal land, as long as the home is treated as real estate under state or Tribal law.22

- The Department of Agriculture guarantees mortgages for rural borrowers who purchase new energy-efficient homes in manufactured home communities if the community is operated by a nonprofit organization or is located on Tribal land and the borrower has a lease that is at least two years longer than the loan term.23

Future Pew research will assess every state’s manufactured home titling laws and analyze what policies are most effective for expanding access to real estate titling. Even small updates to laws have the potential to greatly improve mortgage access for manufactured home buyers, saving them thousands of dollars and enabling them to achieve safe and affordable homeownership.

Acknowledgments

This brief was researched and written by Pew staff members Adam Staveski and Rachel Siegel. The authors thank Pew colleagues Travis Plunkett, Seva Rodnyansky, Tara Roche, Frank Clancy, Sophie Jabes, Matt Mahoney, and Omar Antonio Martínez for providing communications, creative, editorial, and research support for this work.

Endnotes

- “The National Housing Deficit Grew by 159,000 Homes in 2023, Reaching 4.7 Million,” Orphe Divounguy, Zillow, July 9, 2025, https://www.zillow.com/research/housing-deficit-35317/. National Low Income Housing Coalition, “The Gap: A Shortage of Affordable Homes,” 2024, https://nlihc.org/gap. “Make It Count: Measuring Our Housing Supply Shortage,” Elena Patel, Aastha Rajan, and Natalie Tomeh, The Brookings Institution, Nov. 26, 2025, https://www.brookings.edu/articles/make-it-count-measuring-our-housing-supply-shortage/.

- Christopher Herbert, Chadwick Reed, and James Shen, “Comparison of the Costs of Manufactured and Site-Built Housing,” Joint Center for Housing Studies, 2023, https://www.jchs.harvard.edu/research-areas/working-papers/comparison-costs-manufactured-and-site-built-housing.

- “Average Sales Price by State,” United States Census Bureau, June 2025, https://www.census.gov/programs-surveys/mhs/data/annual-data.html. Christopher Herbert, Chadwick Reed, and James Shen, “Comparison of the Costs.”

- Manufactured Home Construction and Safety Standards, 24 CFR Part 3280, Department of Housing and Urban Development, https://www.ecfr.gov/current/title-24/subtitle-B/chapter-XX/part-3280.

- “Real Property vs Personal Property: Types of Property, Chattels, Legal Distinction, and Characteristics,” CollateralFinance, March 10, 2025, https://collateral.finance/real-property-vs-personal-property-differences/.

- “Mobile Roots: The Case for Trailer Park Preservation,” Dalena Collins, National Council on Public History, June 12, 2024, https://ncph.org/history-at-work/mobile-roots-the-case-for-trailer-park-preservation/. “How Much Does It Cost to Move a Mobile Home in 2025?” HomeAdvisor, March 22, 2025, https://www.homeadvisor.com/cost/storage-and-organization/move-mobile-home/. Federal Reserve Bank of Minneapolis and Enterprise Community Partners, “Chapter 11: Manufactured Homes: An Affordable Ownership Option,” in Tribal Leaders Handbook on Homeownership (2018), https://www.minneapolisfed.org/indiancountry/resources/tribal-leaders-handbook-on-homeownership/manufactured-homes-an-affordable-ownership-option.

- Fannie Mae, “Titling Requirements for Manufactured Homes,” 2025, https://www.fanniemae.com/content/guide/titling-requirements-for-manufactured-homes.pdf?_ga=2.66053485.210667105.1603362108-1717120808.1601930950.

- The requirement to pay off a loan before a home can be changed to real estate is often referred to as “lien release,” see: Fannie Mae, “Titling Requirements for Manufactured Homes.”

- The Pew Charitable Trusts, “Manufactured Housing Survey,” 2022, https://www.pew.org/-/media/assets/2025/01/manufactured-housing-survey-toplines-and-methodology.pdf.

- “Community Land Trust (CLT) Mortgages,” Freddie Mac, https://sf.freddiemac.com/working-with-us/origination-underwriting/mortgage-products/community-land-trust-clt-mortgages.

- Buildings; Manufactured Housing, NH Rev Stat § 477:44, State of New Hampshire, 2023, https://law.justia.com/codes/new-hampshire/2023/title-xlviii/chapter-477/section-477-44/. Fannie Mae, “Titling Requirements for Manufactured Homes.”

- The Pew Charitable Trusts, “1 in 5 Manufactured Home Borrowers Use Risky Contract Financing,” 2025, https://www.pewtrusts.org/en/research-and-analysis/issue-briefs/2025/01/1-in-5-manufactured-home-borrowers-use-risky-contract-financing.

- The Pew Charitable Trusts, “1 in 5 Manufactured Home Borrowers.”

- Laurie Goodman and Jun Zhu, “Preventing Foreclosures: What Has Been Done? What Is to Come?” Urban Institute, 2024, https://www.urban.org/sites/default/files/2024-07/Preventing%20Foreclosures_0.pdf.

- “Data Shows Lack of Manufactured Home Financing Shuts Out Many Prospective Buyers,” Linlin Liang, Rachel Siegel, and Adam Staveski, The Pew Charitable Trusts, Dec. 7, 2022, https://www.pewtrusts.org/en/research-and-analysis/articles/2022/12/07/data-shows-lack-of-manufactured-home-financing-shuts-out-many-prospective-buyers.

- Home-only loan interest rates were higher than mortgage interest rates even though home-only loan borrowers had stronger financial characteristics than mortgage borrowers: On average, they made larger down payments and had lower debt-to-income ratios than mortgage borrowers.

- Buildings; Manufactured Housing, NH Rev Stat § 477:44, State of New Hampshire, 2023, https://law.justia.com/codes/new-hampshire/2023/title-xlviii/chapter-477/section-477-44/.

- The Pew Charitable Trusts, “Pew Applauds Washington State Legislature, Governor for Expanding Access to Mortgages for Owners of Manufactured Homes,” news release, April 11, 2025, https://www.pew.org/en/about/news-room/press-releases-and-statements/2025/04/11/washington-state-legislature-governor-for-expanding-access-to-mortgages-for-owners.

- New York State Senate, S.B. S7120 (2025), https://www.nysenate.gov/legislation/bills/2025/S7120.

- Fannie Mae, “Community Land Trust Frequently Asked Questions,” 2025, https://singlefamily.fanniemae.com/media/24896/display.

- Fannie Mae, “Manufactured Housing Loan Product,” 2024, https://www.fhfa.gov/document/mh_real_prop_6_nr_2024.pdf.

- Freddie Mac, “HeritageOne® and Manufactured Homes: Get the Facts,” https://sf.freddiemac.com/docs/pdf/heritageone-mh_factsheet.pdf.

- Updating Manufactured Housing Provisions, 7 CFR Parts 3550 and 3555, Department of Agriculture, Rural Housing Service, 2025, https://www.federalregister.gov/documents/2025/01/03/2024-30270/updating-manufactured-housing-provisions.